17.2 Decision Making with an Internal Risk Model (IRM)

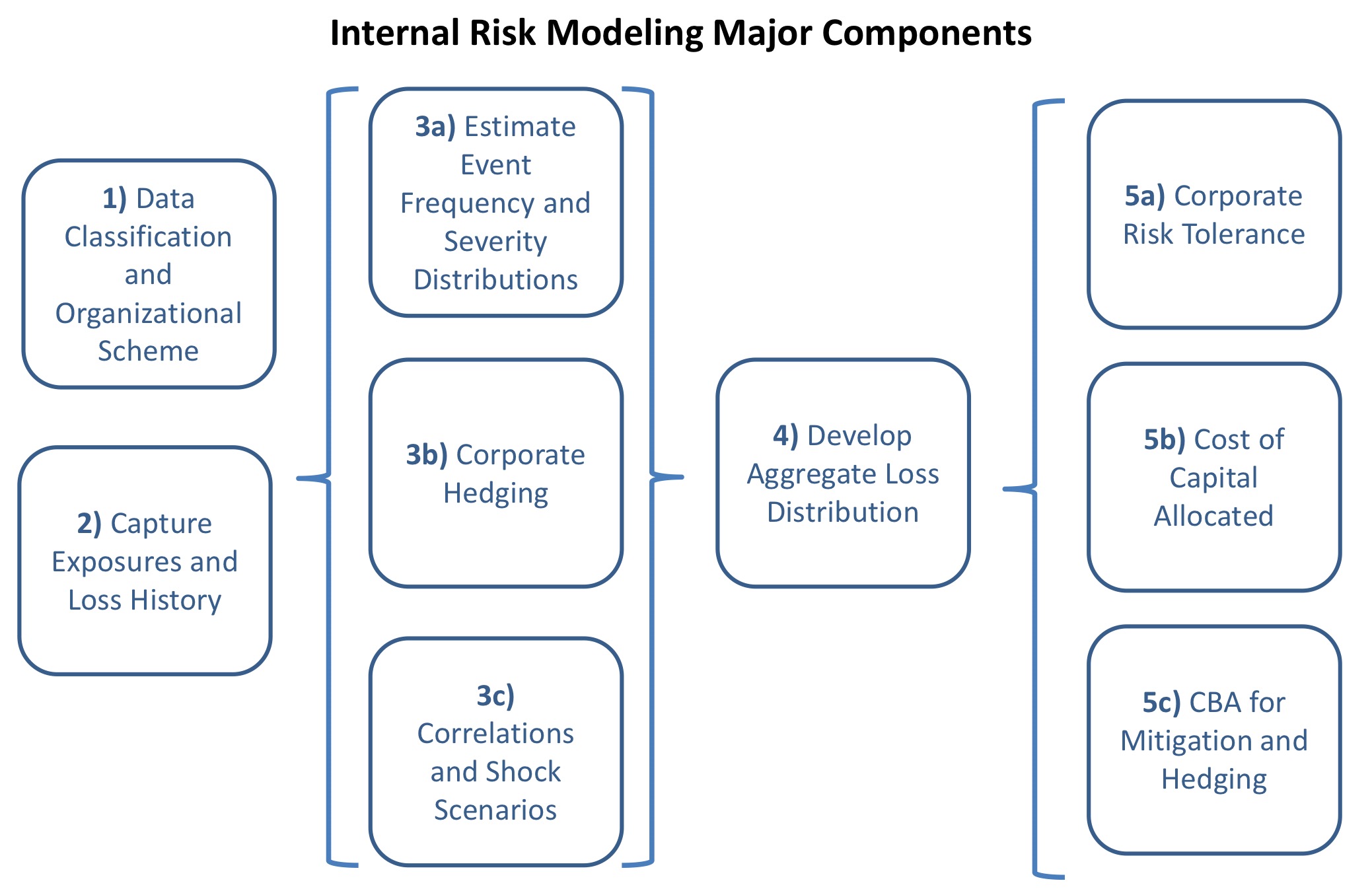

Focus on Element 5 below, 1-4 discussed else where

Figure 17.4: Risk Model Components

Attribute Cost Back to Source of Risk

Estimate aggregate loss distribution (4 Above)

- Distribution of outcomes for each LoB \(\Rightarrow\) Correlate outcomes \(\Rightarrow\) Correlate on external sources

Quantify the impact of the loss outcomes on the organization

Amount of P&L or level of PHS

Can be a distribution

Assign a cost to each amount of impact

- Utility function will be non linear \(\Rightarrow\) Higher cost to events further out in the tail (e.g. $20m loss is more than twice as bad as a $10m loss)

Attribute cost to source (e.g. BUs)

17.2.1 5a - Corporate Risk Tolerance

Definition 17.1 Corporate risk tolerance

How much risk a company is willing to take

What tradeoffs the company is willing to make in terms of reduction in expected profits to reduce risk

How much fluctuation in annual results it is willing to bear

- Needed in Steps 2 and 3 above

Corporate risk tolerance is a combination of the following factors:

Organization Size: Depending how much capital a firm have to deploy to invest in project each year changes how big an investment is

Capital: The % impact to the firm’s total capital is more telling than the nominal value \(\Rightarrow\) Firm with higher capital can tolerate bigger nominal value volatility

Volatility:

Investors might want steady stream of dividend paid \(\Rightarrow\) Lower risk tolerance

Public firms with quarterly earnings are rewarded for having consistent predictable profits \(\Rightarrow\) Lower risk tolerance

Private firm can afford to have more volatile results

17.2.1.1 Risk Preference Function

Risk tolerance can be defined by a risk preference function (or utility function)

- Translation of impact into cost requires a risk preference function

Properties of risk preference function

Non linear e.g. \(U(x) = A + B \cdot \operatorname{ln}[x+c]\) or \(U(x) = A - e^{ -x / R }\)

Slope decrease further into profit while increases further into losses

- A linear straight line represents risk neutral utility

Source of risk preference function

Implicitly taken from an outside source (e.g. capital market)

Explicitly derived from firm management attitudes

See section below from Spetzler

Spetzler’s process output a transparent, objective, mathematical expression of the corporation’s acceptable risk-reward tradeoff

This can improve cost-benefit analysis (CBA) by quantifying the minimum decrease in risk sufficient to justify a certain mitigation cost

Without such a function, CBA can still be made but will be inconsistent and opaque driven by the individual decision makers’ intuitions and preferences

Walls show how to select projects with the efficient frontier and utility curve

17.2.1.2 Spetzler

“The Development of Corporate Risk Policy for Capital Investment Decisions” - Spetzler 1968

Paper found that managers have very different risk tolerate and found that they are likely to be too conservative for small projects (damages not meaningful to the firm as a whole)

Useful for management to:

see the different utility curves for different managers

make decisions on where the company utility curve should be and communicate that to the day to day decision makers

Benefits of Utility Curve:

Transparent, objective mathematical expression of the firm’s acceptable risk/reward trade offs

Without, risk/reward decisions criteria will be inconsistent and opaque and driven by individuals

17.2.1.3 Walls

“Combining decision analysis and portfolio management to improve project selection in the exploration and production firm” - Walls 2004

Calculates efficient frontier \(\Rightarrow\) Estimate risk tolerance \(\Rightarrow\) Where on the frontier to select the best portfolio

Efficient Frontier

Given \(n\) projects with \(\operatorname{E}[NPV_i]\) and \(\sigma_i\), the firm can choose to participate on each project with % \(x_i\)

Given the budget based on current portfolio, an efficient frontier is built based on the lowest portfolio \(\sigma\) given different expected NPVs

- They note that the current portfolio is not optimal

The next 3 point is to decide where on the efficient frontier to be on

Risk Tolerance

Risk tolerance level \(R\) and utility function tells you where the firm choose to be on the efficient frontier

\(R\) is estimated based on where the decision maker is indifferent from a gamble of 50% of \(R\) and 50% of \(-R/2\) and not taking it (take the expected value?)

Expected value is \(\dfrac{R}{4}\)

Utility Function

\[U(x) = 1 - e^{ - x / R}\]

Tell us how much risk is the firm willing to tolerate

How much reward are we willing to give up for a given reduction in risk and vice versa

Certainty Equivalent

With the above, calculate Certainty Equivalent (CE) of a given portfolio:

- CE = The fixed amount that the firm is indifferent between taking the risky portfolio or the fixed amount

CE changes based on the \(R\) selected

Pick the portfolio with the highest CE

Negative CE means the firm would be better of not investing in it

Firm must answer these questions:

How much risk are we willing to tolerate (Picking \(R\))

How much reward are we willing to give up for a given reduction of risk and vice versa (Expressing its risk preference, utility curve)

Are the risk-reward trade offs available along the efficient frontier acceptable to us (Answer by the first 2 points)

17.2.2 5b - Cost of Capital Allocated

Definition 17.2 Risk capital is a measure of firm’s total risk bearing capacity

It is only an aggregate measure

It gives counterparty confidence that the financial firm can perform

- Still an open question in actuarial science

17.2.2.1 Allocation

Cost of risk capital is being allocated, not the capital itself

Allocation of risk capital is theoretical since no capital is actually transferred to the policy

Useful to allocate risk capital to risk-taking units

(And non risk-taking units too maybe)

Total risk capital required is reduced by diversification benefits and the contributions to risk are not linear (See ERA 2.2)

Return on Risk Adjusted Capital (RORAC)

Risk capital allocation is use as an interim step in assigning the cost of risk capital to portfolio elements

Allocate capital in a risk adjusted way \(\Rightarrow\) Riskier sources require more capital

Apply firm wide hurdle rate to determine cost of capital for each portfolio elements (e.g. BU)

\(\neq\) RAROC as RAROC adjusts the hurdle rate and does not allocate capital in a risk adjusted way

Bypassing Allocation

Mango argues that concept of allocating capital is meaningless as each risk source has access to the capital of the firm (i.e. the entire pool of risk capital is a shared asset)

Focus on cost of capital the risk source uses we get a direct answer

Bypass allocation and goes straight to the cost

How to determine the cost is the difficult part

Idea is based on Merton and Perold where they define risk capital as the amount needed to guarantee the performance of the intermediary’s contractual obligations at the default-free level

- The cost of purchasing this protection in the market is the cost of risk capital

A good candidate for decision variable is EVA if we only have cost of risk capital:

EVA

EVA = Economic Value Added = NPV - Cost of Capital

EVA > 0 means BU is adding value

17.2.3 5c - CBA for Mitigation

Cost-benefit analysis (CBA):

- We can do this once we have the corporate risk tolerance and capital cost allocation

CBA with EVA

- Mitigation effort that has positive EVA should be done

CBA with Capital Allocation

- Projects that reduce capital cost by more than the cost of the project should be undertaken