9.1 Introduction

Paper focus on over-dispersed Poisson (ODP) bootstrap

Incremental losses are modeled as ODP random variable

Goal is to generate a distribution of possible outcomes

Just FYI, not important for exam

Other papers on bootstrap

-

Statistics: Bradley Efron (1979)

-

Actuarial: England & Verrall (1999; 2002), Pinheiro, et al. (2003), Kirschner, et al. (2008)

Practical motivation for modeling loss distribution

Definition of actuarial estimate in ASOP 43 can be based on a first moment from a distribution

- While ASOP 36 (SAO) focus on deterministic point estimates

SEC is looking for more information on reserving risk in the 10-K

Rating agencies are building dynamic risk models and welcome actuary input

Companies that use dynamic risk models for internal risk management need unpaid claim distributions

SII and IFAS are moving towards unpaid claim distribution

Advantages of bootstrap

Generates a distribution of the estimate of unpaid claims

Can be tailored to statistical features of our data

Reflects that loss distn are usually skewed to the right

Disadvantages of bootstrap

- Takes more time to create, but okay once set up

9.1.1 Stochastic vs Static Model

ODP bootstrap is a specific form of GLM

Benefit of GLM: It can be specifically tailored to the statistical features found in the data

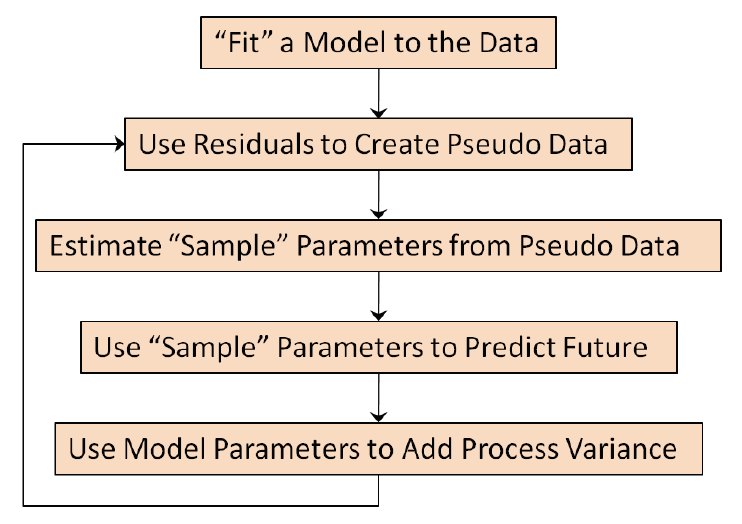

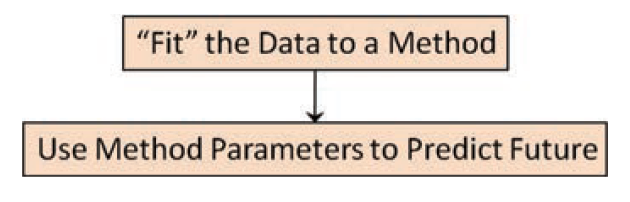

- Contrast with algorithms that force the data to be fit to a static model (fig. 9.1)

Figure 9.1: Stochastic vs Static Model Diagram

Just FYI, not important for exam

Some authors define a model as having a defined structure and error distribution, so under this more restrictive definition bootstrapping would be considered to be a method or algorithm

However, using a less restrictive definition of a model as an algorithm that produces a distribution, bootstrapping would be defined as a model