11.4 Models Overview

Starting point for the Bayesian models were to relax some of the assumptions of the Mack method:

LCL: Relaxes the first assumption where Mack treats loss to date as a fixed level parameters

CCL: Builds on top of LCL and allows for AY correlations, which relaxes the 2nd assumption of Mack

Prior distributions

Paper uses diffuse prior for the most part since the author doesn’t have direct knowledge of the business

Given more direct knowledge of the underlying business, we can specify more restrictive priors for \(\{\alpha_w\}\) and \(logelr\)

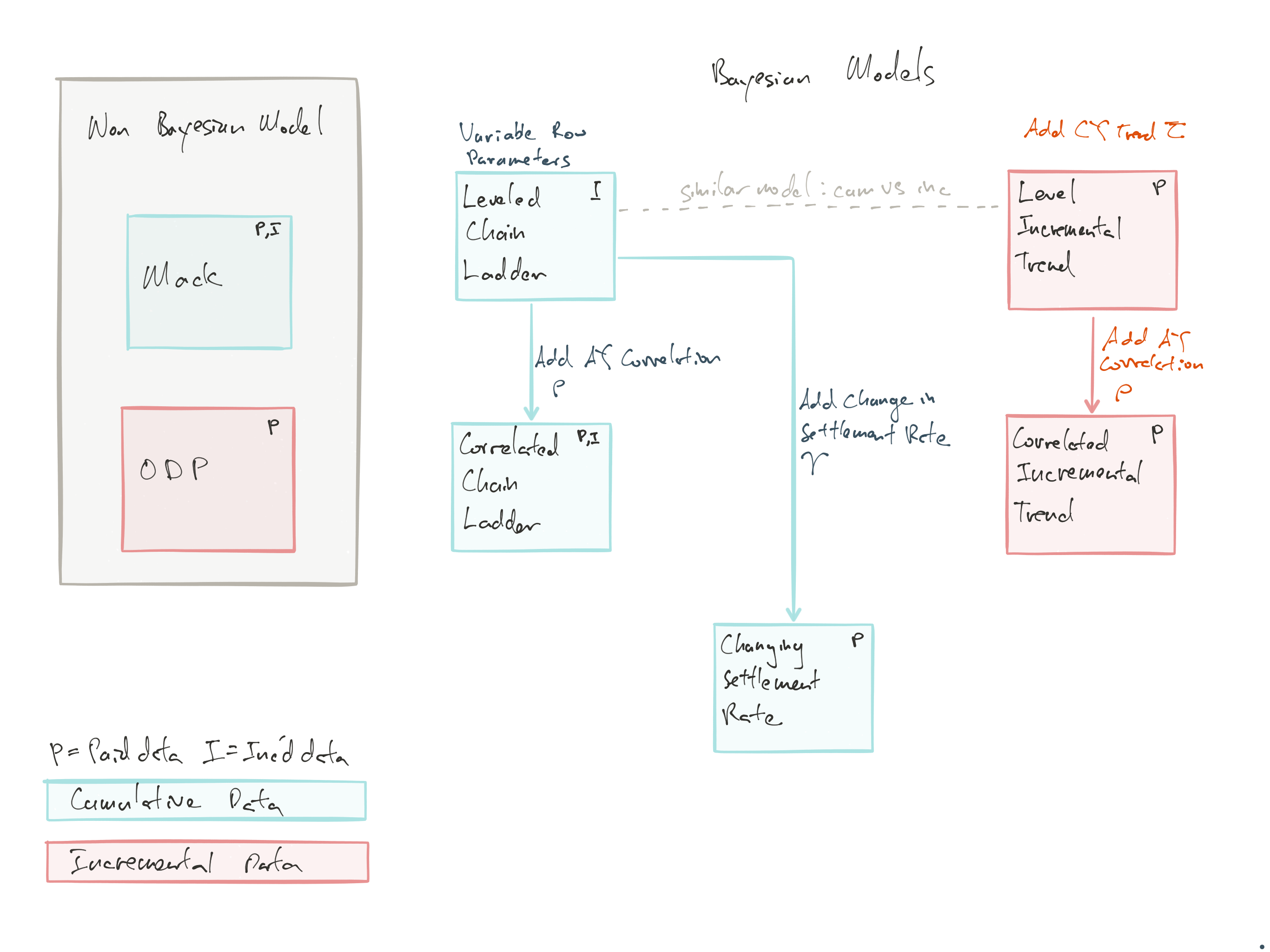

Bayesian Models:

Leveled Chain-Ladder (LCL): Add variability to the row parameter

Correlated Chain-Ladder (CCL): Add AY correlation \(\rho\)

Leveled Incremental Trend (LIT): Use skewed distribution and CY trend \(\tau\)

Correlated Incremental Trend (CIT): LIT with added AY correlation \(\rho\)

Changing Settlement Rate (CSR): LCL with speed up claims closure \(\gamma\)

Figure 11.3: Overview of models

Non-Bayesian Models:

England & Verall ODP: See Shapland, but doesn’t have the residual adjustments

Remark. Non-Bayesian Models

Mack is the only one that does not have a base form of \(\mu_{wd} = \alpha_w + \beta_d\)

- ODP is the England & Verall Bootstrap