15.7 Past Exam Questions

Concepts

\(\star\) 2011 - #12 a: higher \(g\) should be matched with higher \(\beta\) for being more risky

2011 - #12 c: relationship between \(g\) and \(k\)

2015 #17 b-c: \(\beta\) discussion

DDM

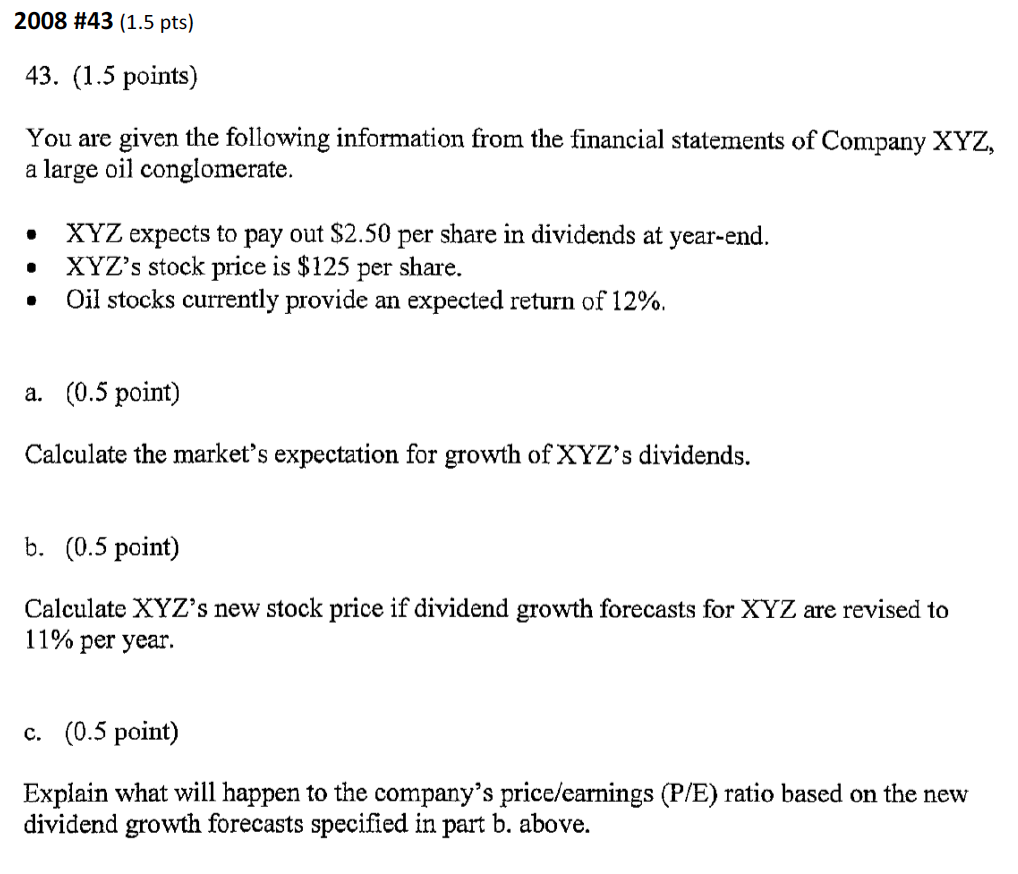

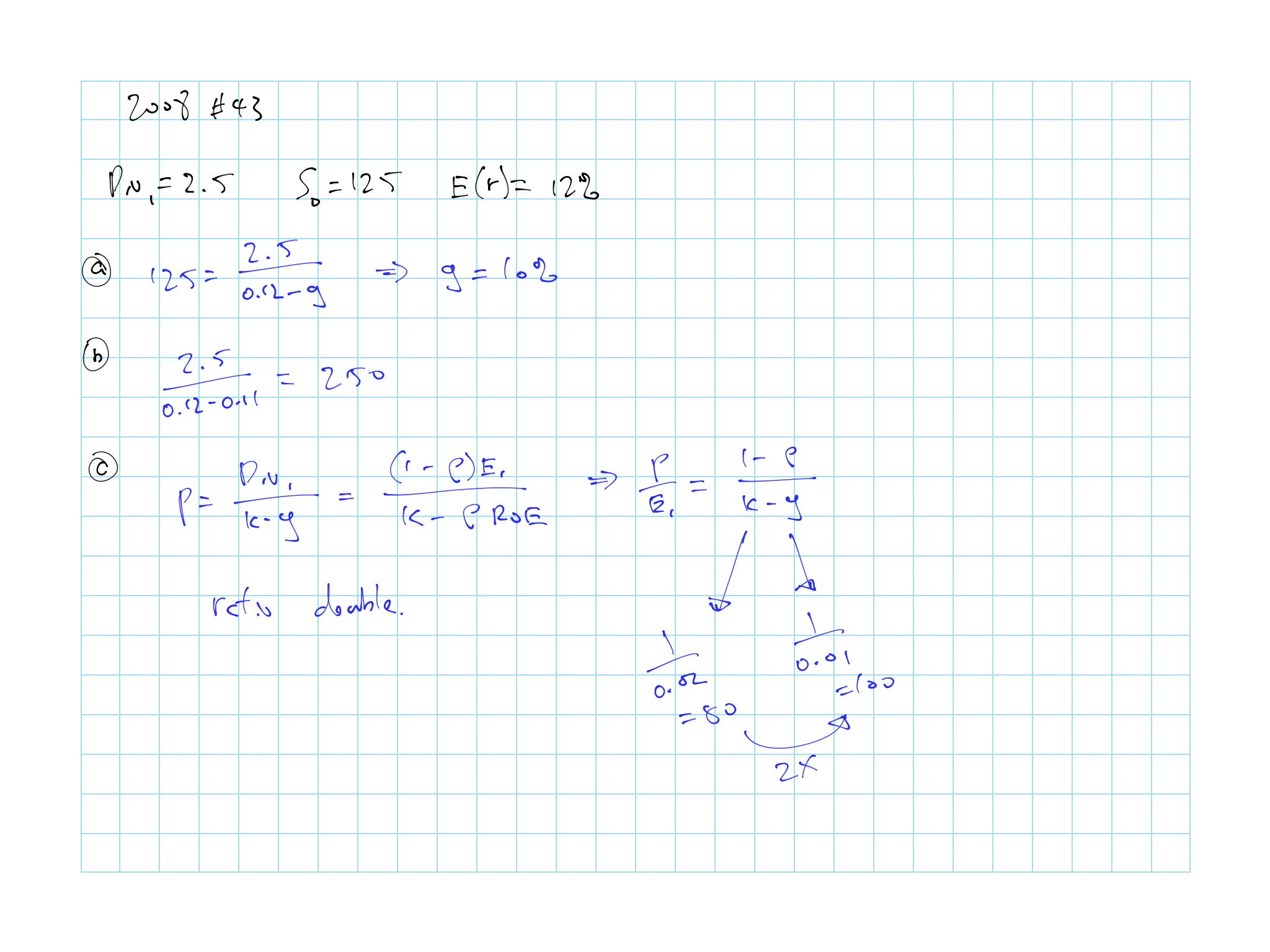

2008 #43 15.1: DDM calc and convert to P:E

\(\star\) 2008 #44: DDM calc and interpretation

2008 #45: Comparison on P:E

2009 #34

\(\star\) 2011 - #12 b: DDM calc (Get \(r_f\) as t-bond less liquidity premium)

- \(\star\) High growth should be more risky and have higher \(\beta\)

\(\star\) 2012 #12 15.5: Full calc with DDM

2014 #16: DDM calc

2015 #17 a: DDM calc

FCFE

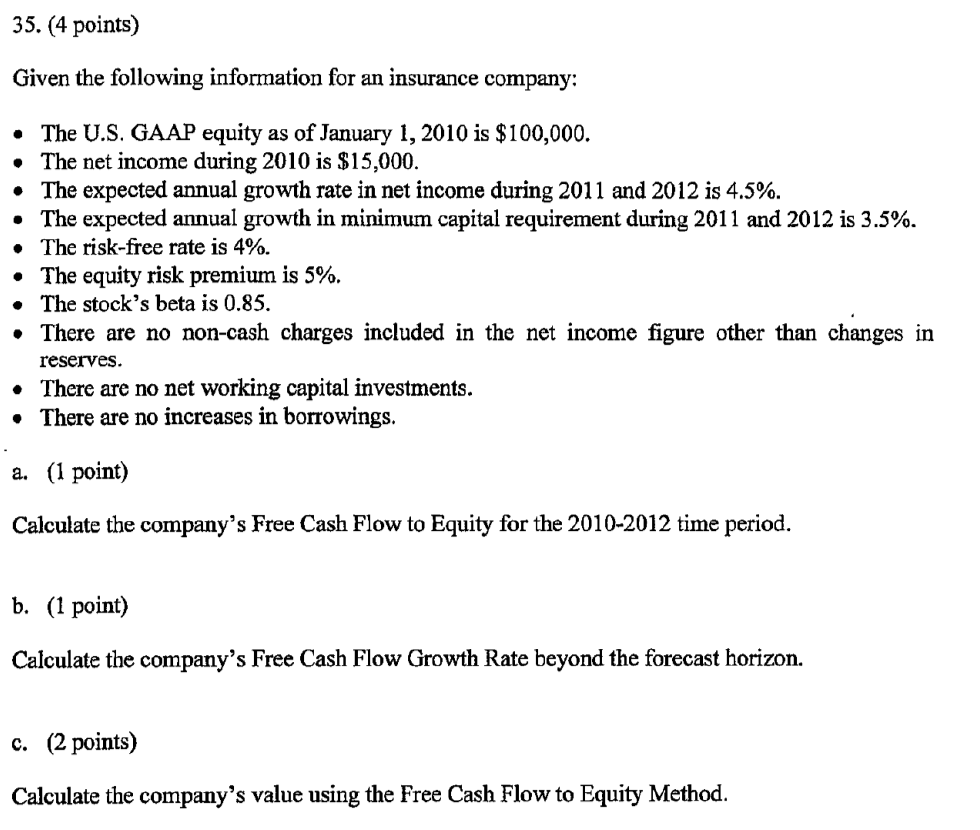

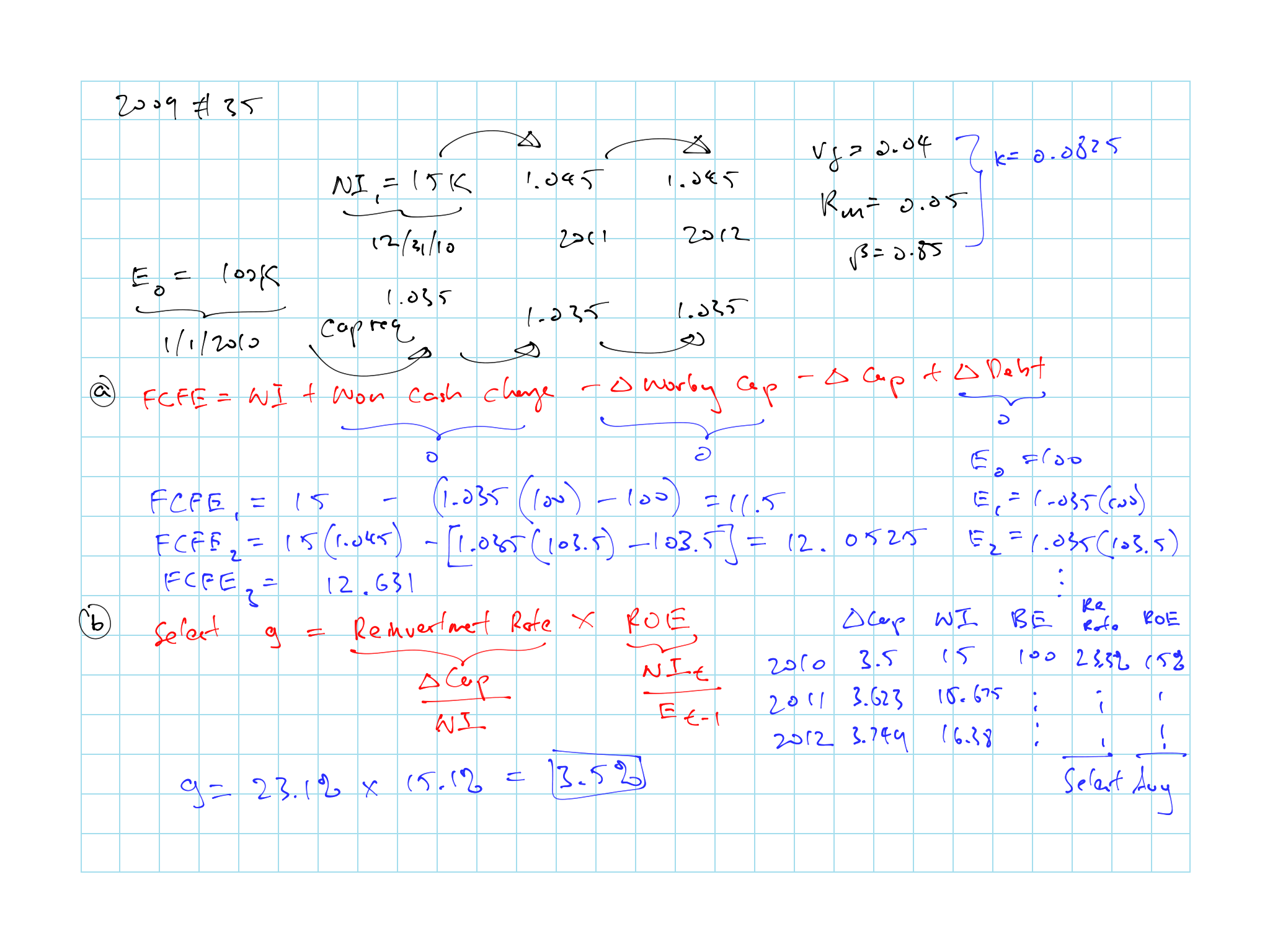

\(\star\) 2009 #35 15.2: Full FCFE calc

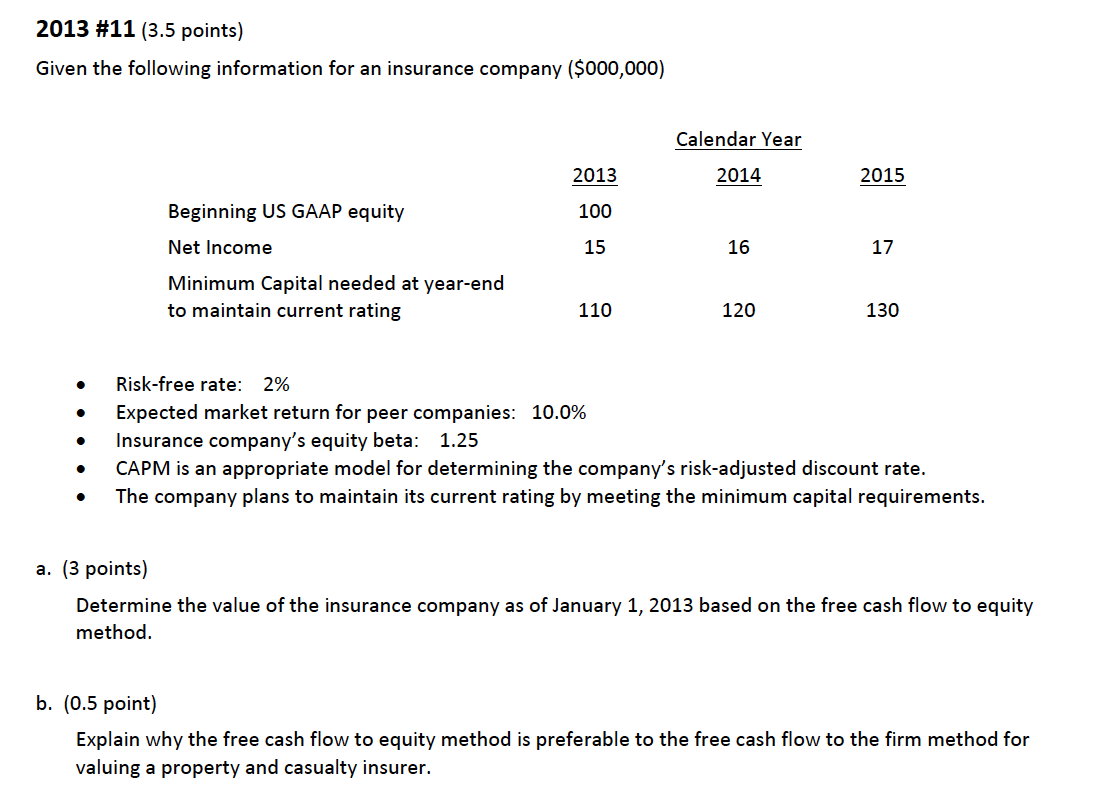

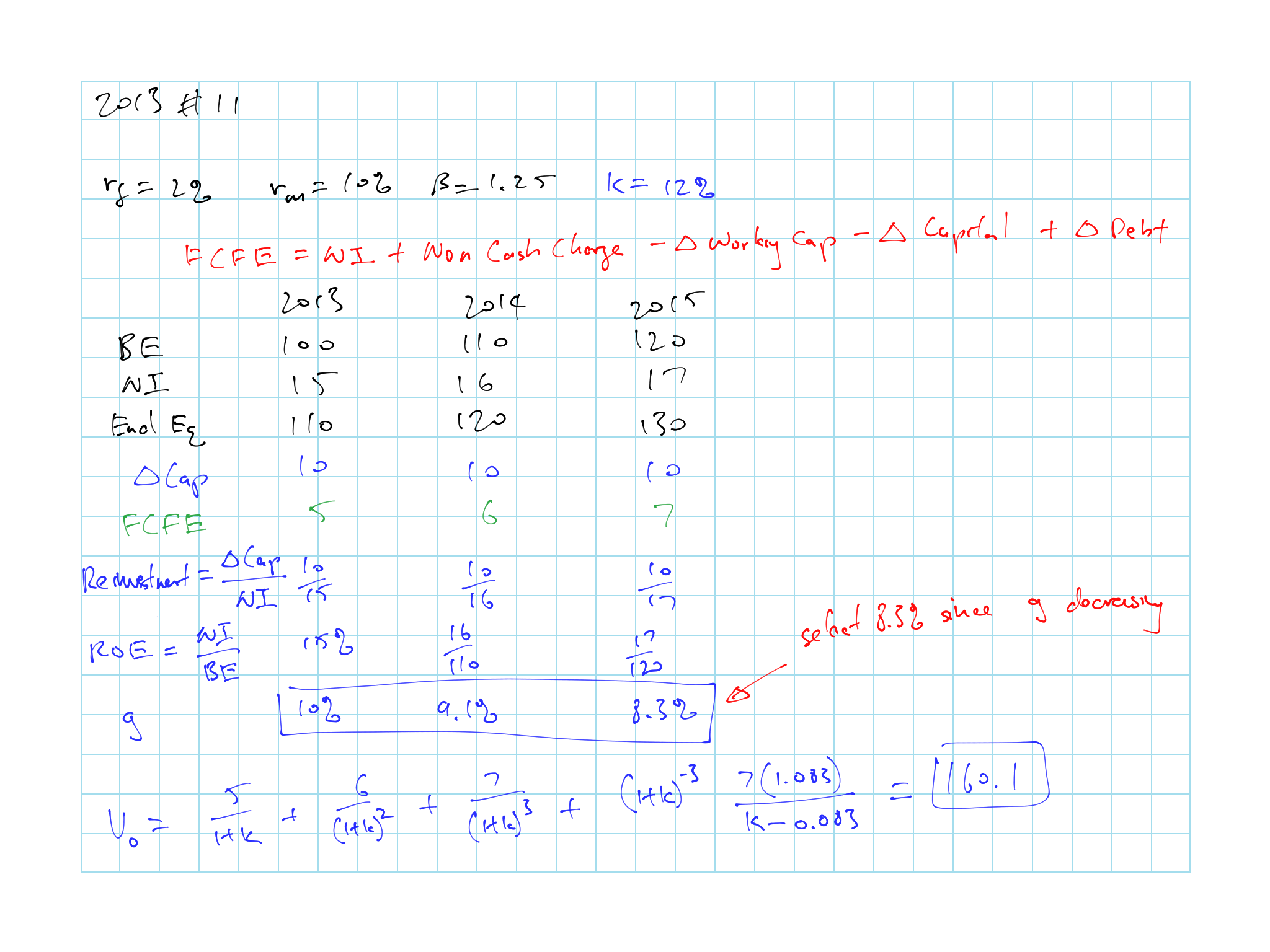

\(\star\) 2013 #11 15.6: Full FCFE calc with discussion

- Flow to Equity vs to firm

2014 #17: FCFE Calc

\(\star\) 2015 #16: Discussion on DCF

2016 #19: FCFE

AE

\(\star\) 2010 #31 15.3: Full AE calc

2013 #12: Full AE Calc + discussion (AE vs DDM)

2015 #15: AE Calc + discussion

TIA 1: AE calc and P:E and interpretation

Relative Valuation

2011 - #13 15.4: Price to Book value calc + discussion on assumption

- \(\star\) Why and why not the growth should continue

\(\star\) 2014 #15: Price to Book calc using all the ratios given by LoB

2016 #20: P:E and P:B ratios

\(\star\) TIA 2: Need to know to use price to book

- \(\star\) Convert P:B to value, know what BV includes

Option pricing

TIA 3: Black scholes on projects

TIA 4: How to value firm as call option and why it doesn’t work for P&C companies

TIA 5: Real options

15.7.1 Question Highlights

Figure 15.1: 2008 Question 43

Figure 15.1: 2008 Question 43

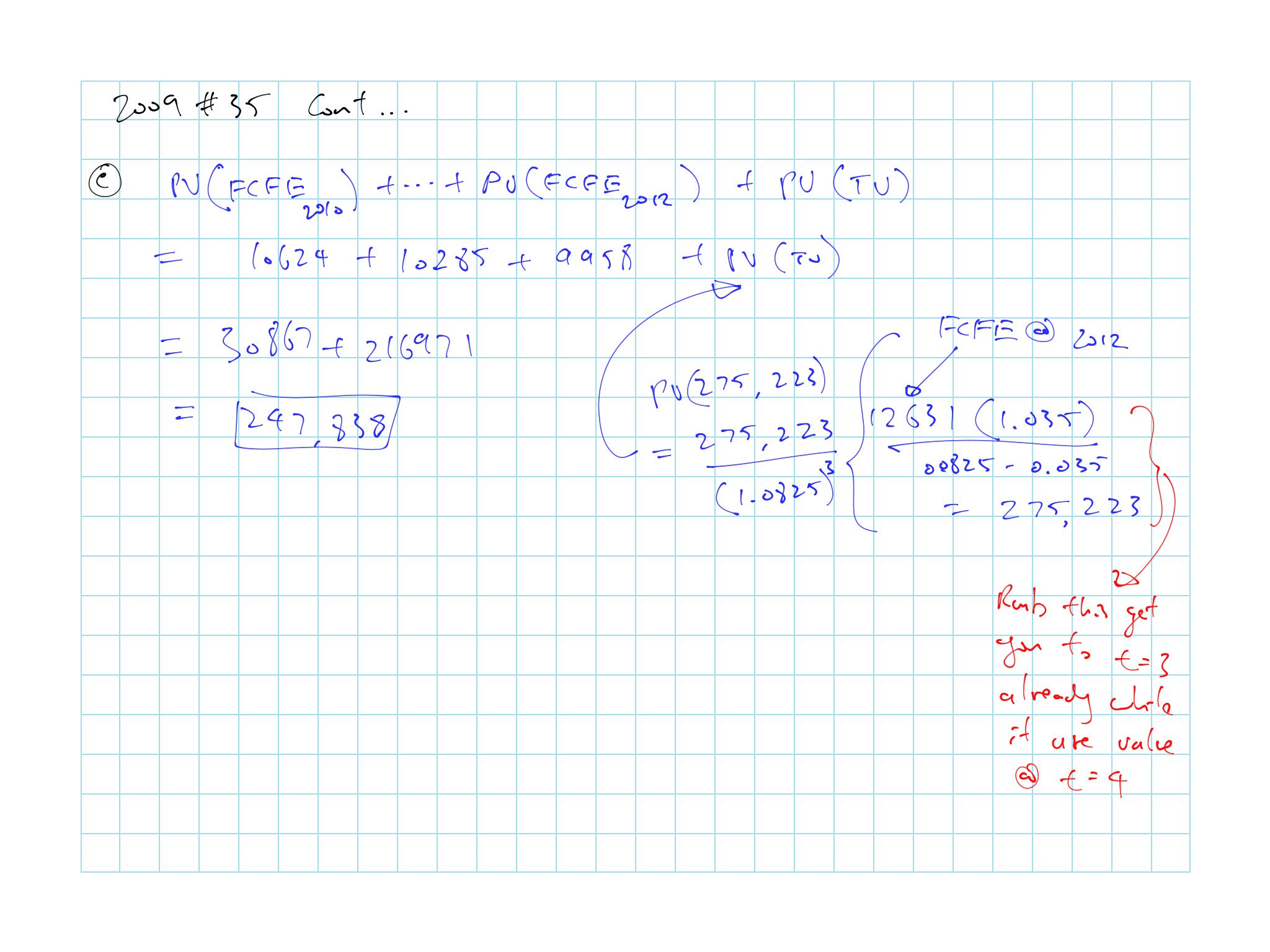

Figure 15.2: 2009 Question 35

Figure 15.2: 2009 Question 35

Figure 15.2: 2009 Question 35

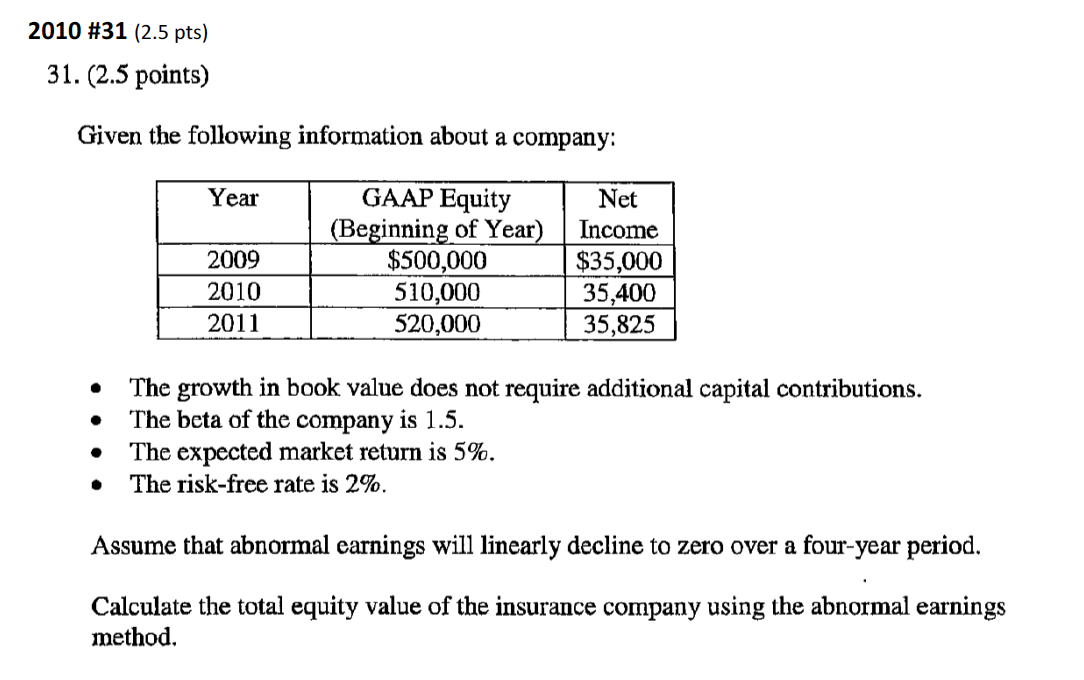

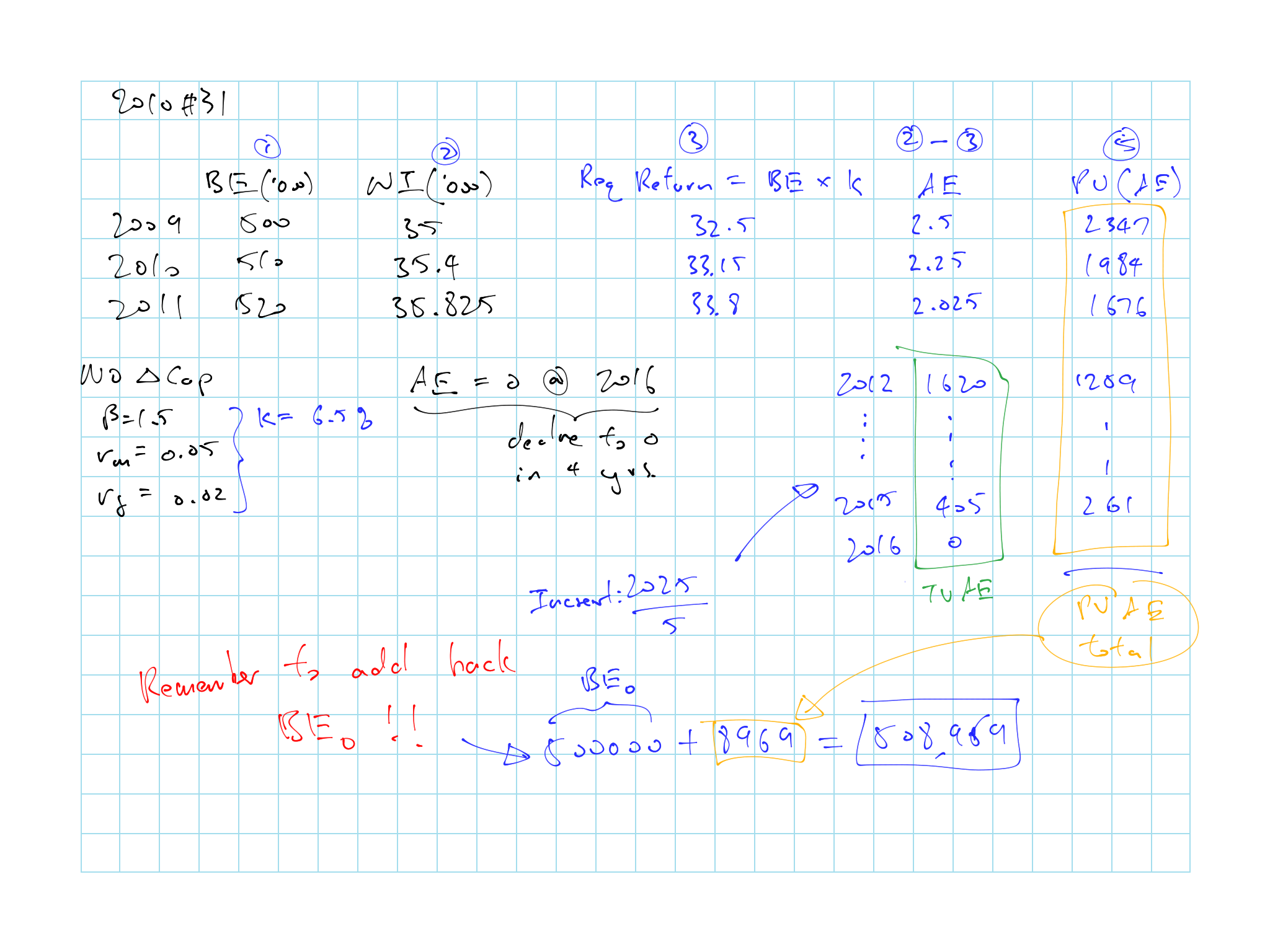

Figure 15.3: 2010 Question 31

Figure 15.3: 2010 Question 31

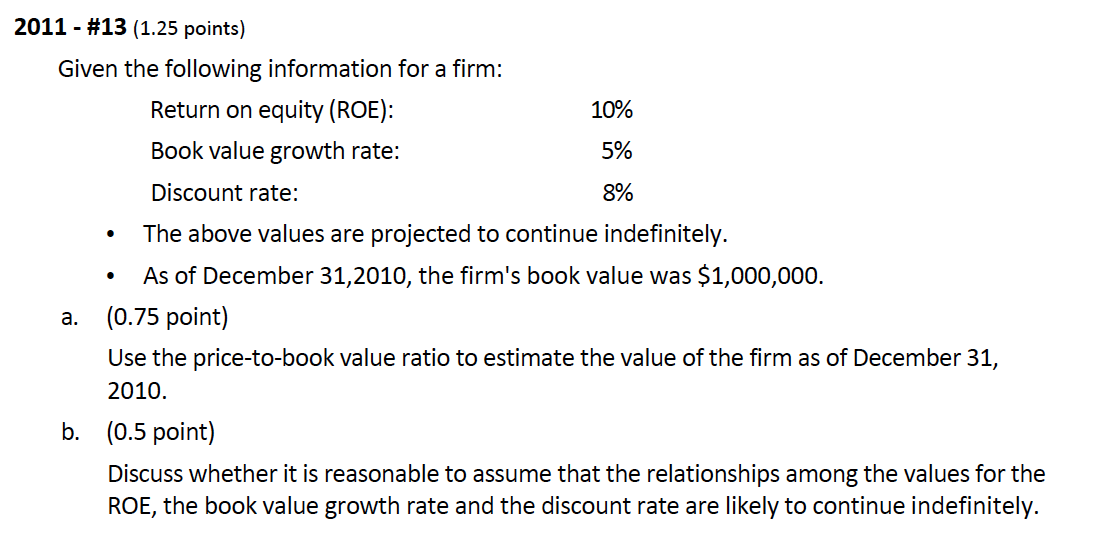

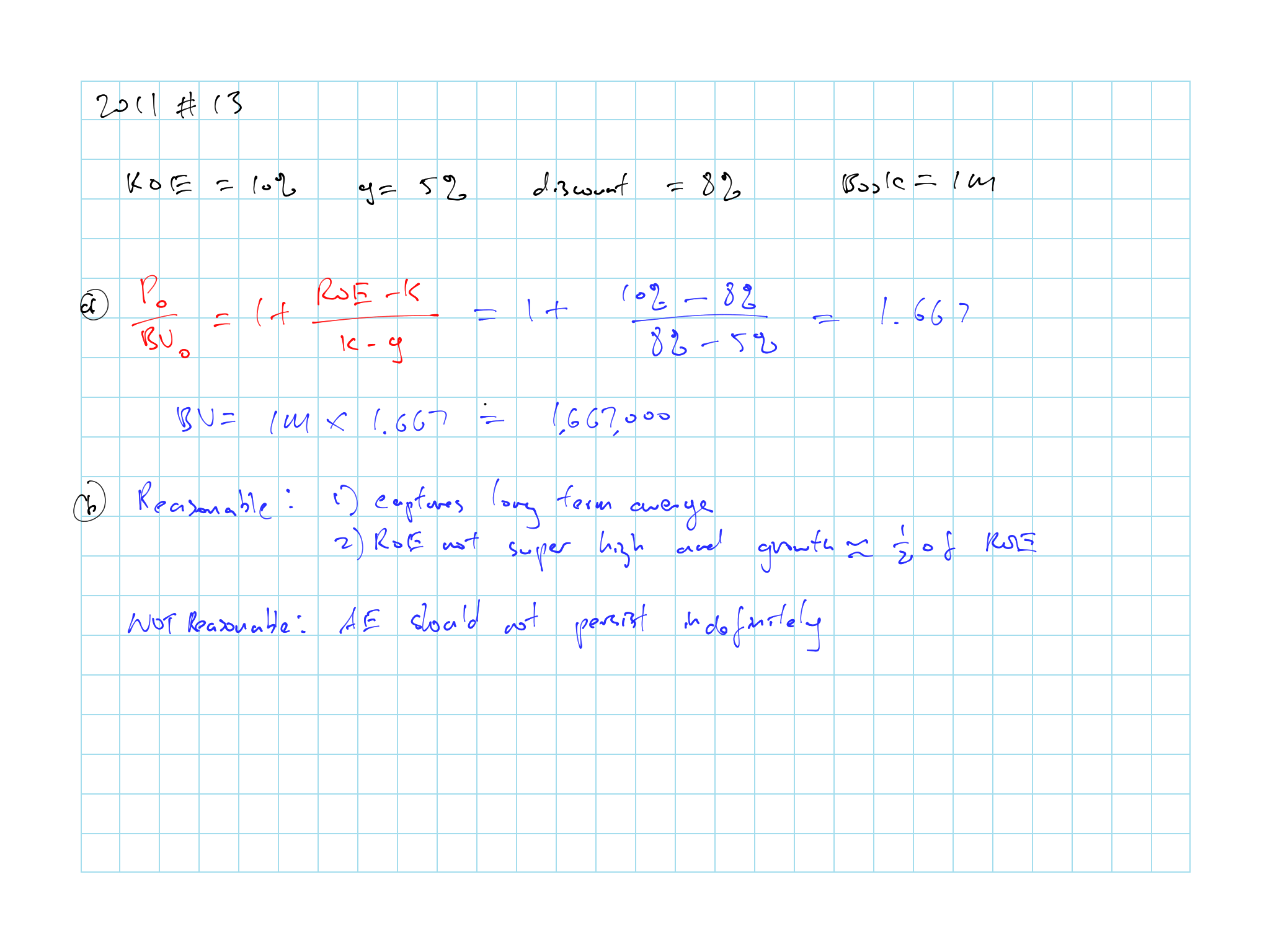

Figure 15.4: 2011 Question 13

Figure 15.4: 2011 Question 13

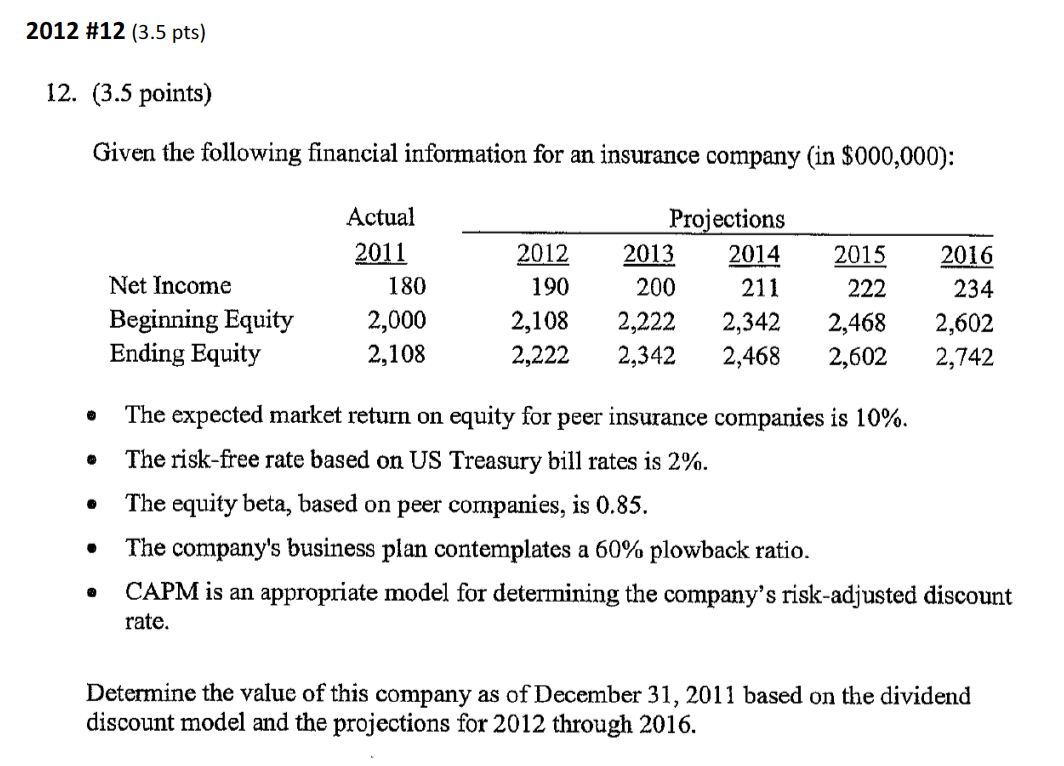

Figure 15.5: 2012 Question 12

Figure 15.5: 2012 Question 12

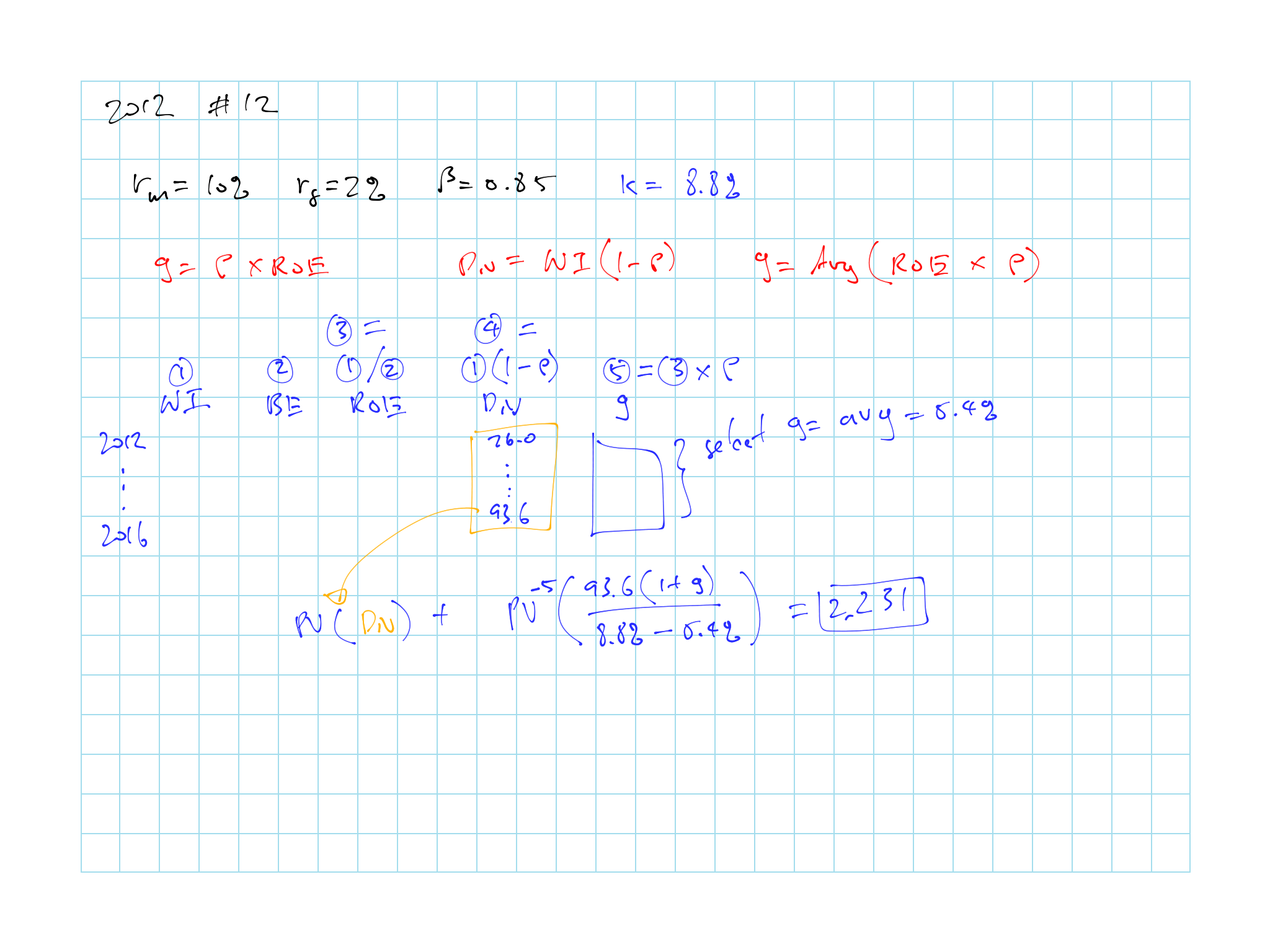

Figure 15.6: 2013 Question 11

Figure 15.6: 2013 Question 11