14.6 Past Exam Questions

Concepts

1998 - #55: formula vs empirical, expected difference given a scenario

2001 - #39 b: PDLD ratio pattern

First adjustment the basic premium is included in the retro premium computation; Small portion of loss is limited by the retro; LCF and TM also impacts it

At later periods, more losses are capped by the limit

2003 - #9: Loss capping ratio properties Double check

2003 - #10: Feldblum comment on Teng Perkins: premium responsiveness decreases at higher LR for a book of business

2007 - #36: Retro premium and reported losses relationship on graph

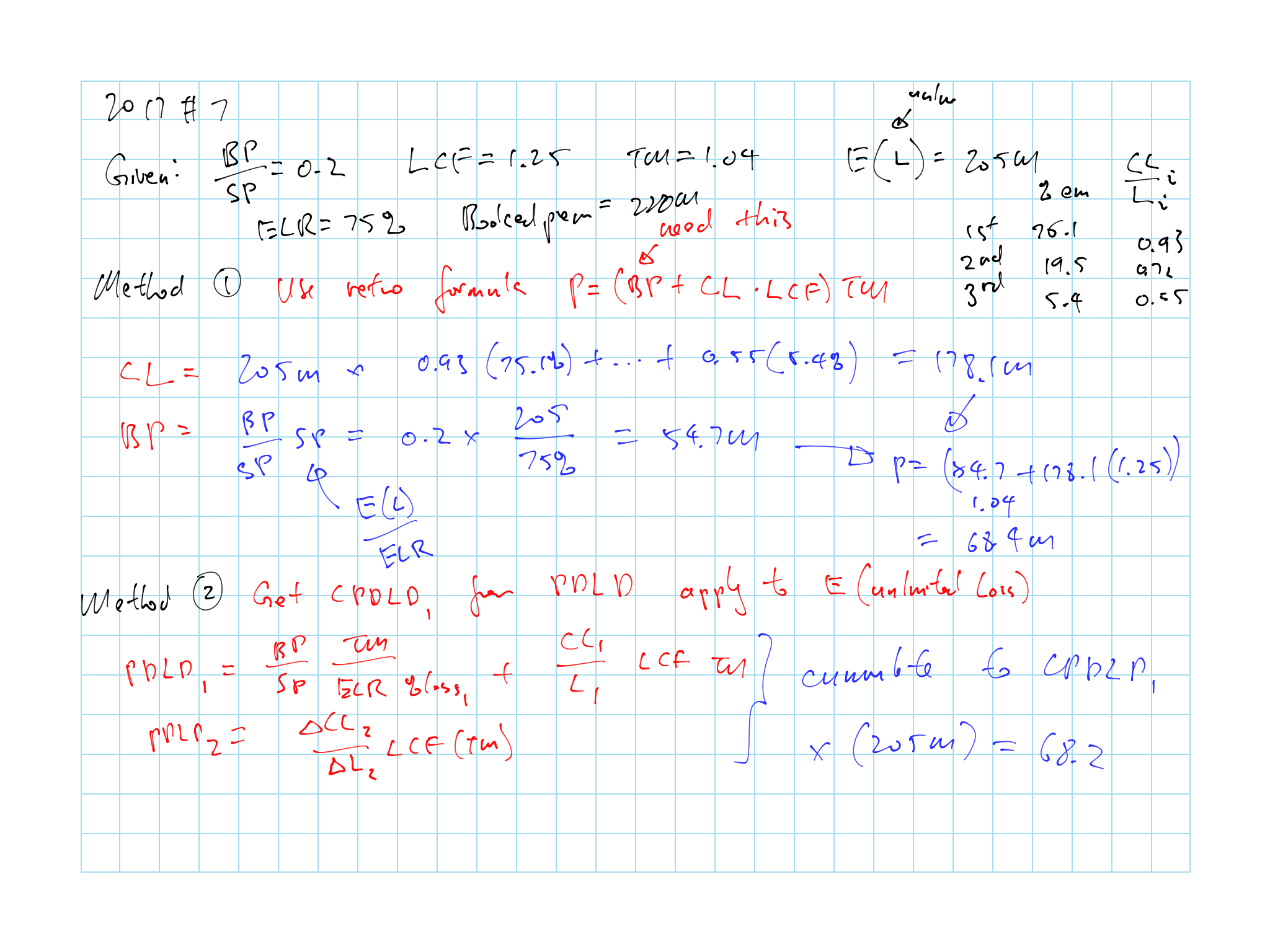

\(\star\) 2014 #12 14.4: incremental losses vs premium relationships

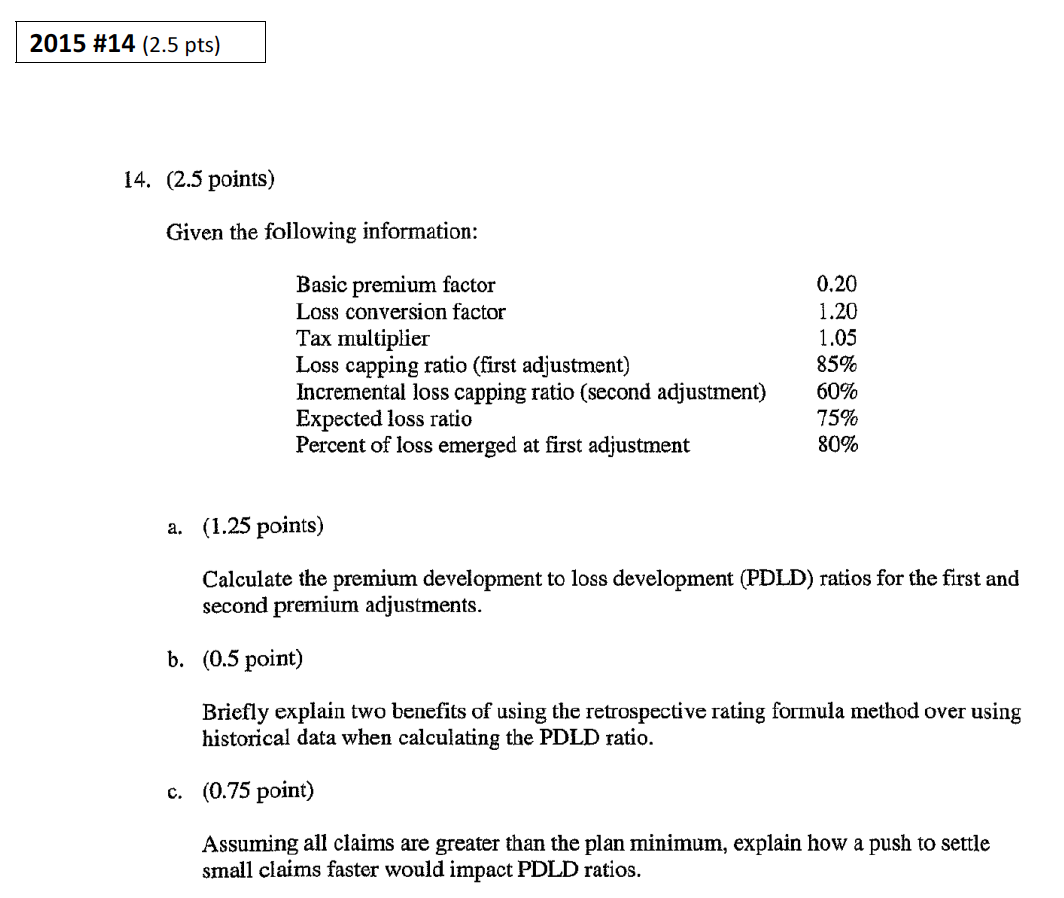

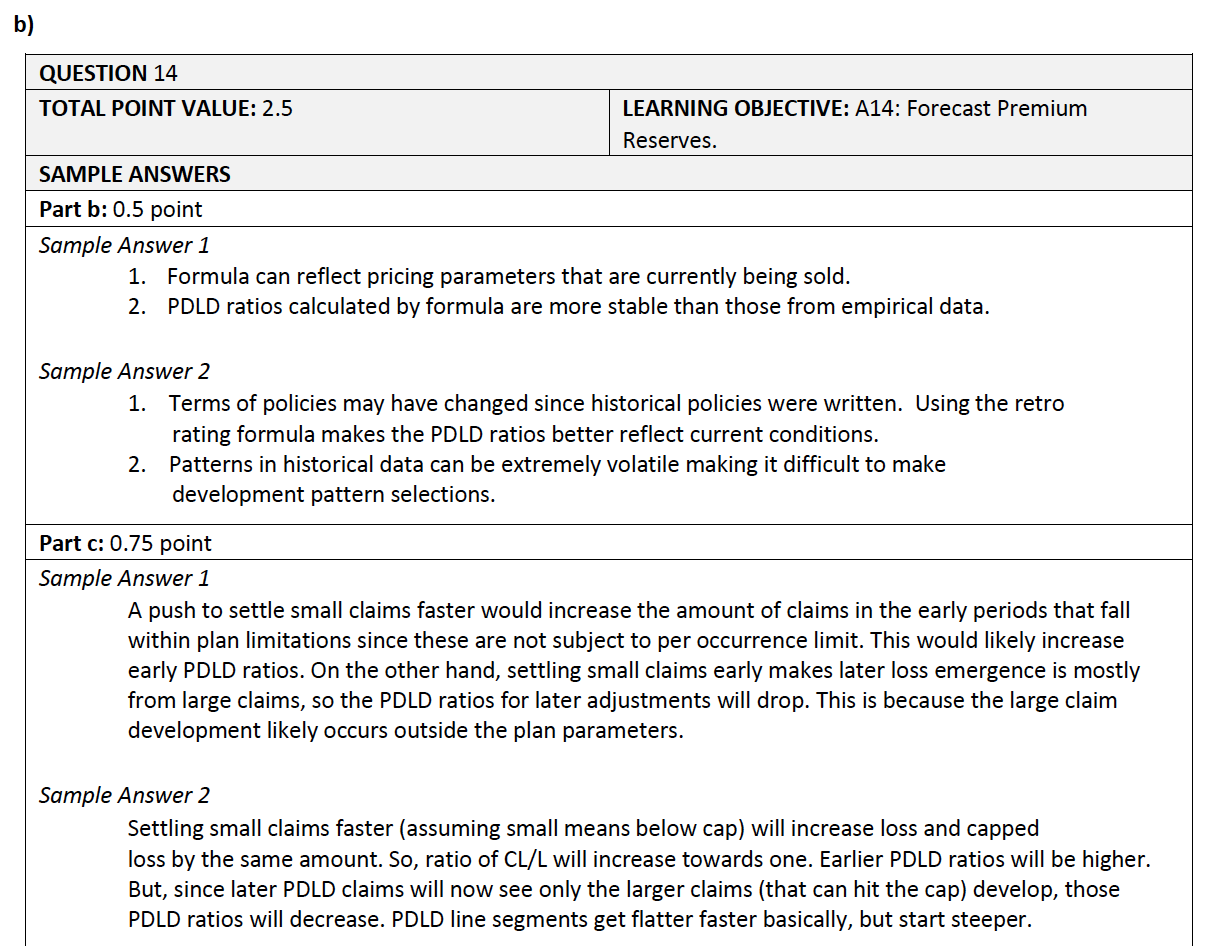

\(\star\) 2015 #14 14.5: PDLD ratio

TIA 2b: Difference in the first period

Calculations

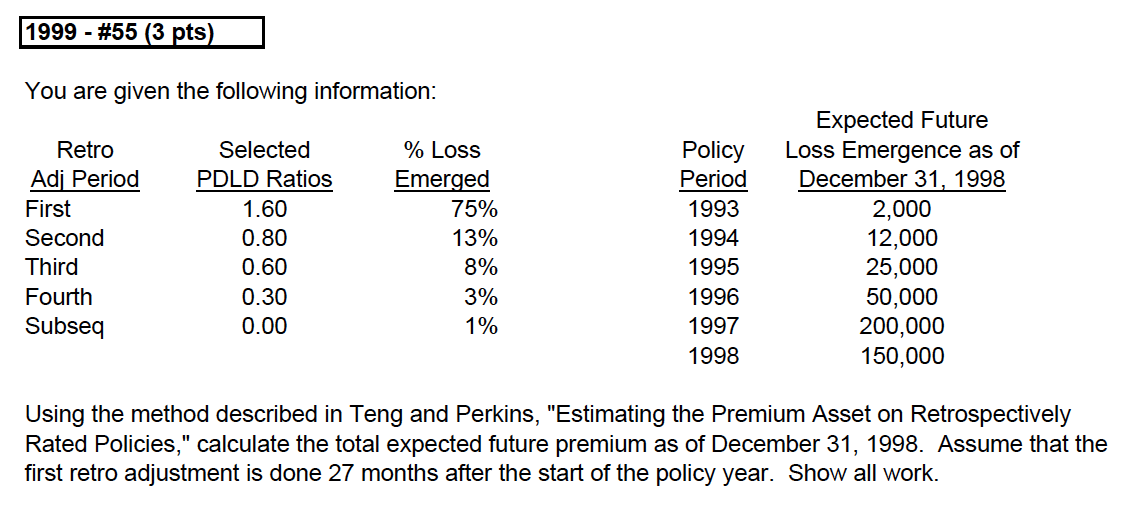

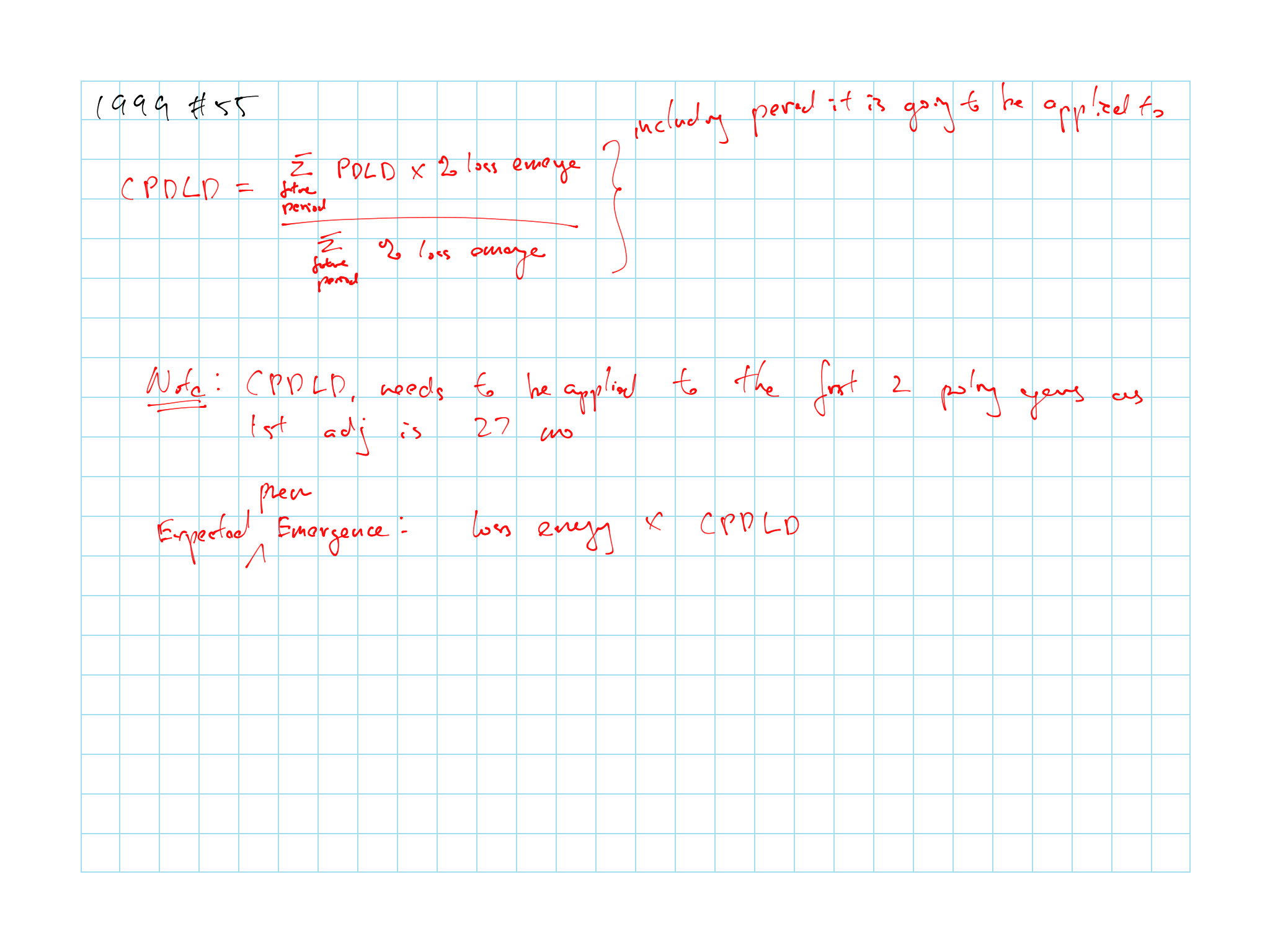

\(\star\) 1999 - #55 14.1: Calculating CPDLD and expected future premium

- Remember to apply \(CPDLD_1\) to all policies that have not have an adjustment

2001 - #39 a: CPDLP

2002 - #14: Premium asset = Expected Future Premium + Premiums booked from prior adjustment - premium booked as of current

2004 - #7: Empirical PDLD ratio

2005 - #20: Premium asset calc with PDLD

\(\star\) 2006 - #23: \(PDLD\) from formula and why the loss capping ratios decrease over time

2007 - #5: \(PDLD_2\) plug and play

2008 - #14: premium asset

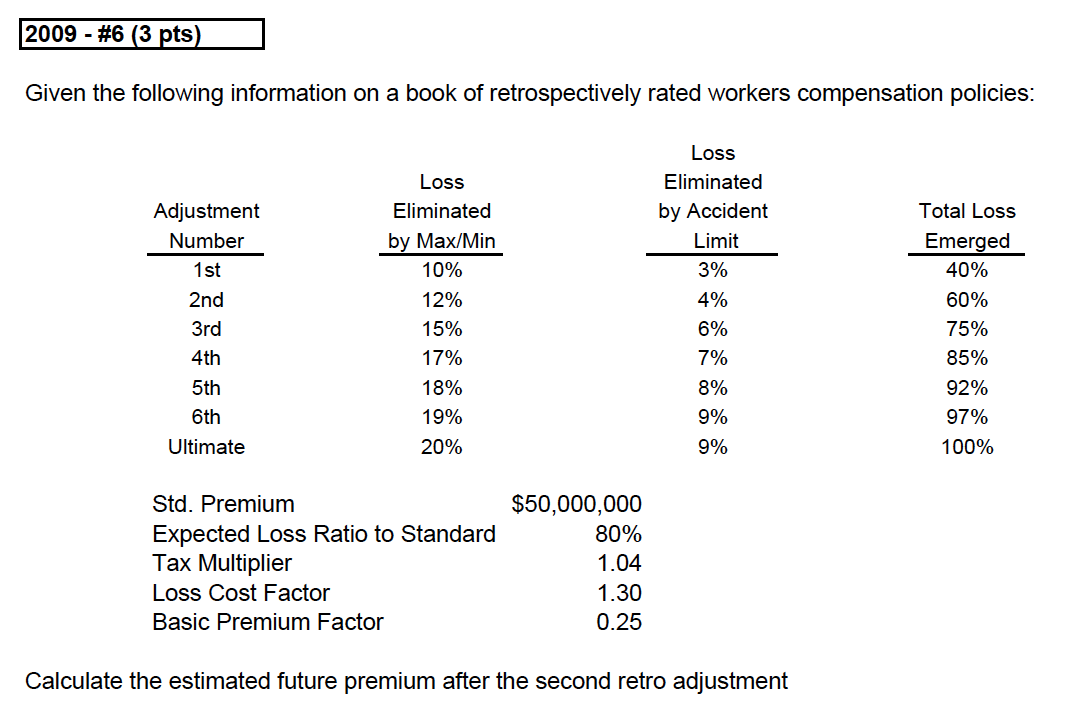

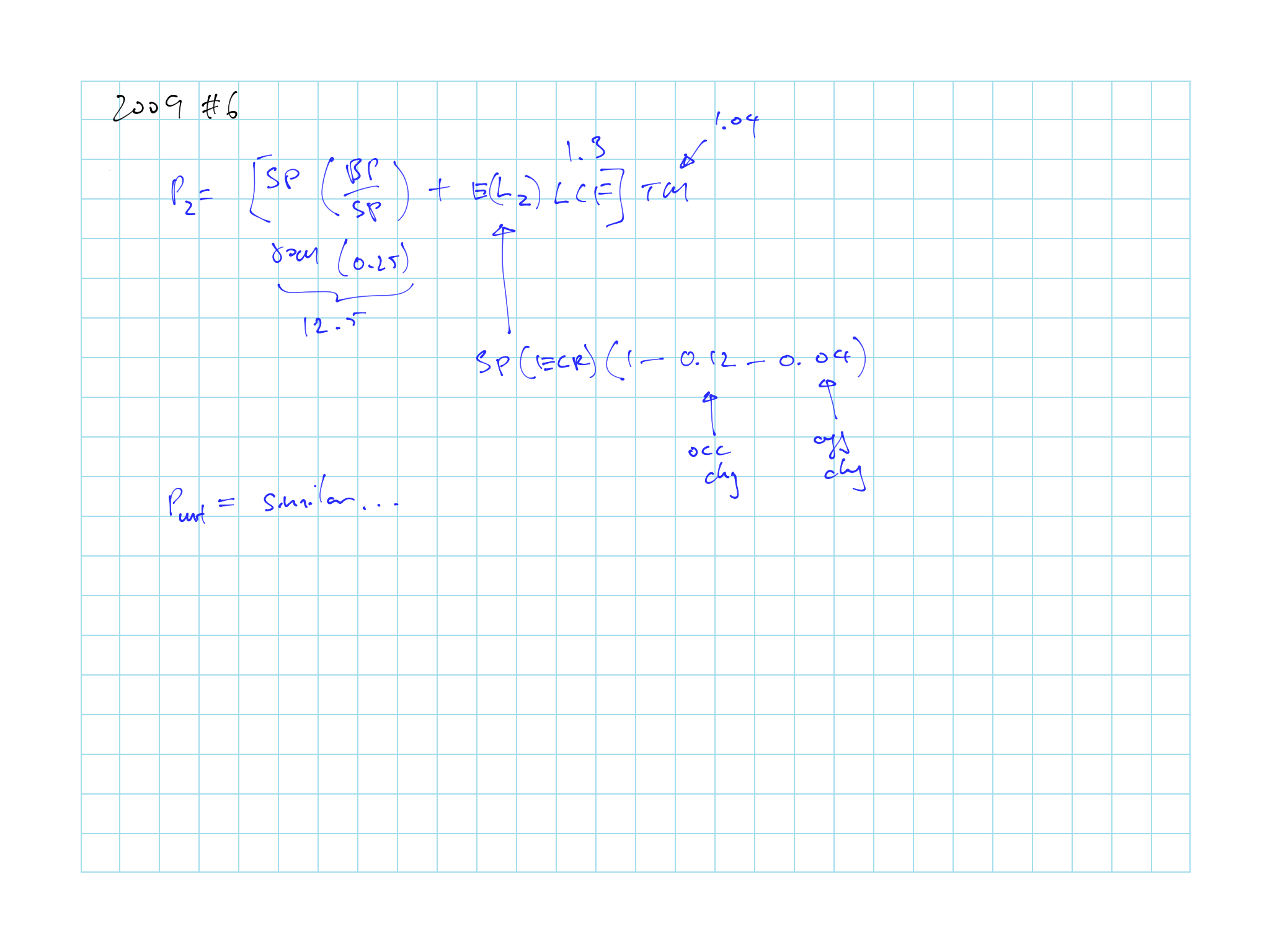

\(\star\) 2009 - #6 14.2: Premium after 2nd retro adjustment

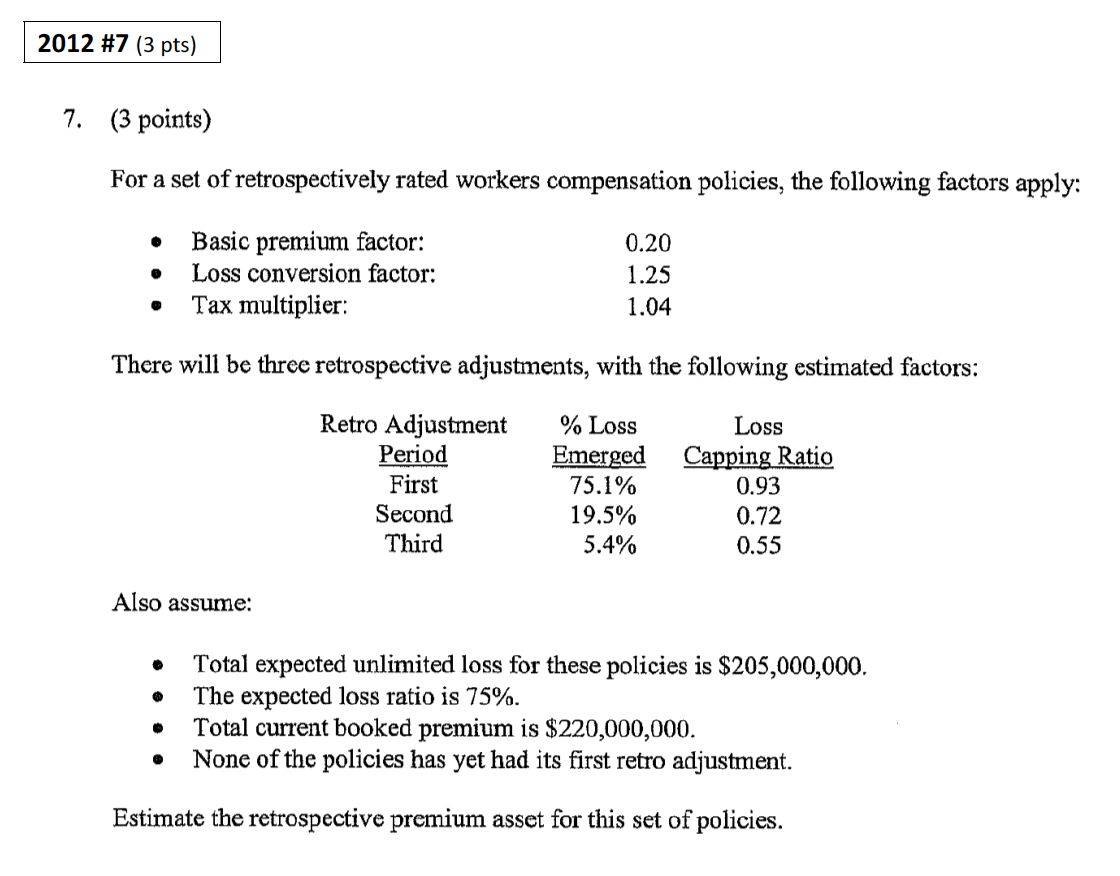

\(\star \star\) 2012 - #7 14.3: Retrospective premium asset, good question, 2 methods to do

- Can calculate a weighted capping ratio

\(\star\) 2013 #6 a-c: PDLD 1 to 3 and relationship with loss capping ratio, ratio should decrease monotonically

- State whether you using the loss capping ration as cumulative or incremental

2015 #14 a: PDLD 1 and 2 plug and play

\(\star \star\) 2016 #18: quarter calculation premium asset

TIA 1: Retro formula plug and play

TIA 2a: plug and play

\(\star\) TIA 3: PDLD and CPDLD and practical application

\(\star\) TIA 4: CPDLD for all AYs and premium asset

\(\star \star\) TIA 5: Premium asset for quarterly eval

TIA 6: PDLD calc given loss and premium

\(\star\) TIA 7: CPDLD, using the enhancement

14.6.1 Question Highlights

Figure 14.1: 1999 Question 55

Figure 14.1: 1999 Question 55

Figure 14.2: 2009 Question 6

Figure 14.2: 2009 Question 6

Figure 14.3: 2012 Question 7

Figure 14.3: 2012 Question 7

Figure 14.4: 2014 Question 12

Figure 14.4: 2014 Question 12

Figure 14.5: 2015 Question 14

Figure 14.5: 2015 Question 14