7.9 Past Exam Questions

Concepts

1998 - #41: Discuss methods and pros/cons

2000 - #4: Relativities relationship

2001 - #11: Development method process

2002 - #28 b: Pros/cons implied development

2005 - #19 b c: Inflation index limit, implied dev advantages

2006 - #6: LR approach advantage

2008 - #12 b: LR method pros and cons

2011 - #6 c: BF pros (more stable and can be tied to pricing estimates)

Simple Plug and Play Calculations

2001 - #23: Loss ratio method for aggregate loss charge

2002 - #28 a c: XS deductible IBNR reserve and service revenue

2003 - #8: Loss ratio method for losses XS aggregate limit

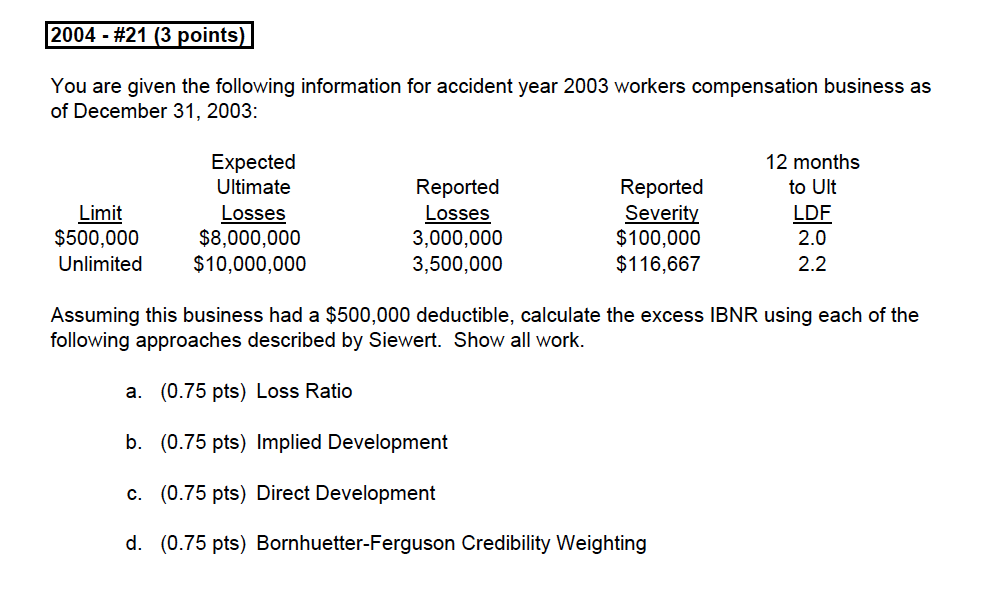

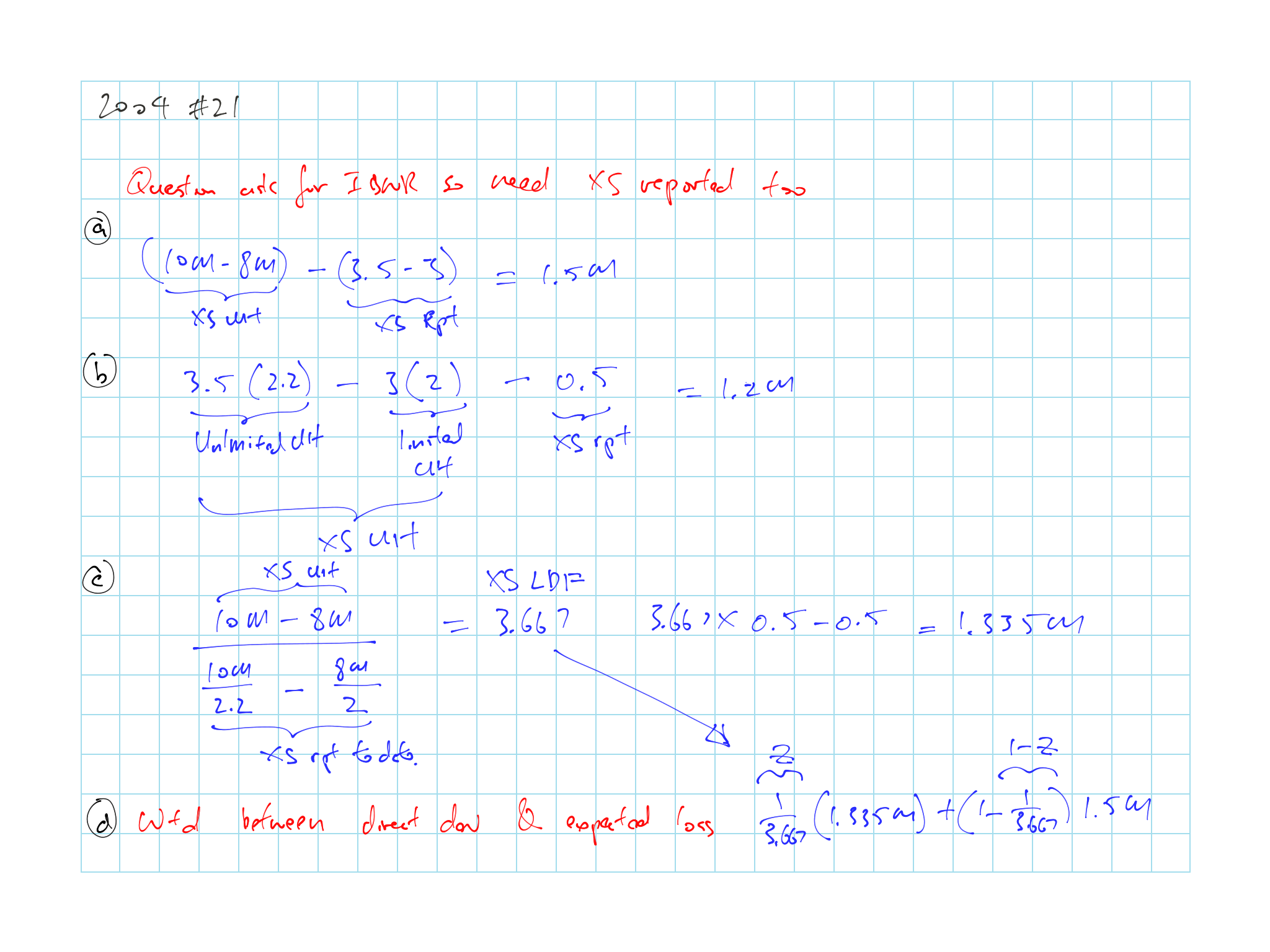

\(\star\) 2004 - #21 (7.1): IBNR using LR, implied, direct, BF

2005 - #19 a: Implied LDF method

2008 - #12 a: LR method both occ and aggregate

2010 - #3: Back out limited LDF

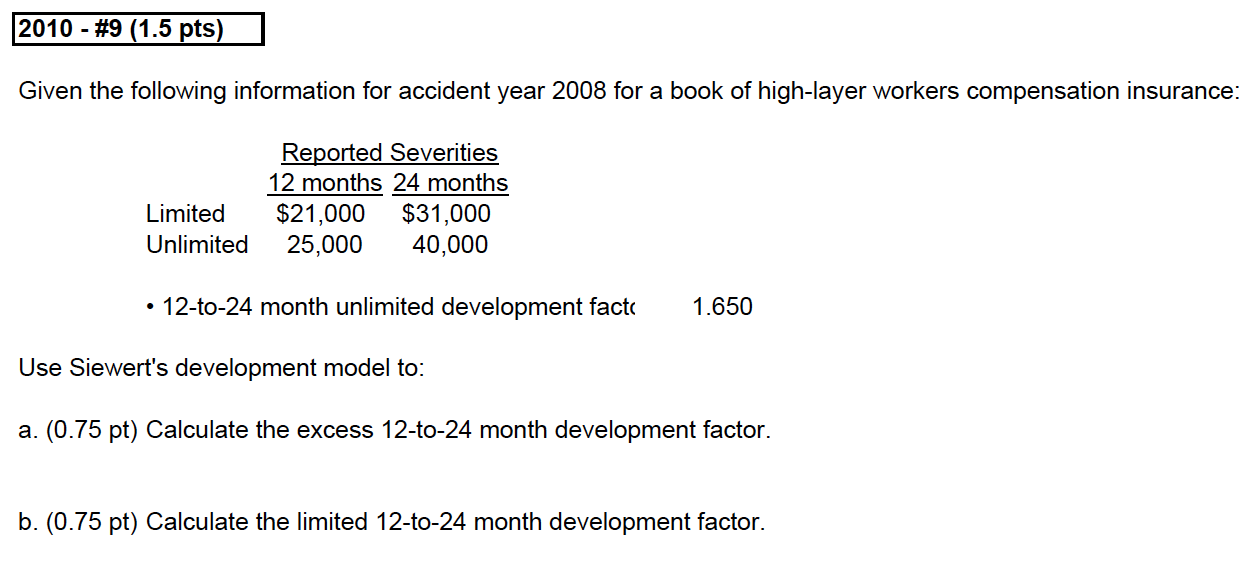

\(\star\) 2010 - #9 (7.3): XS limited LDF based on relativity

2012 - #6: Get unlimited with limited and XS and relativity with the formula

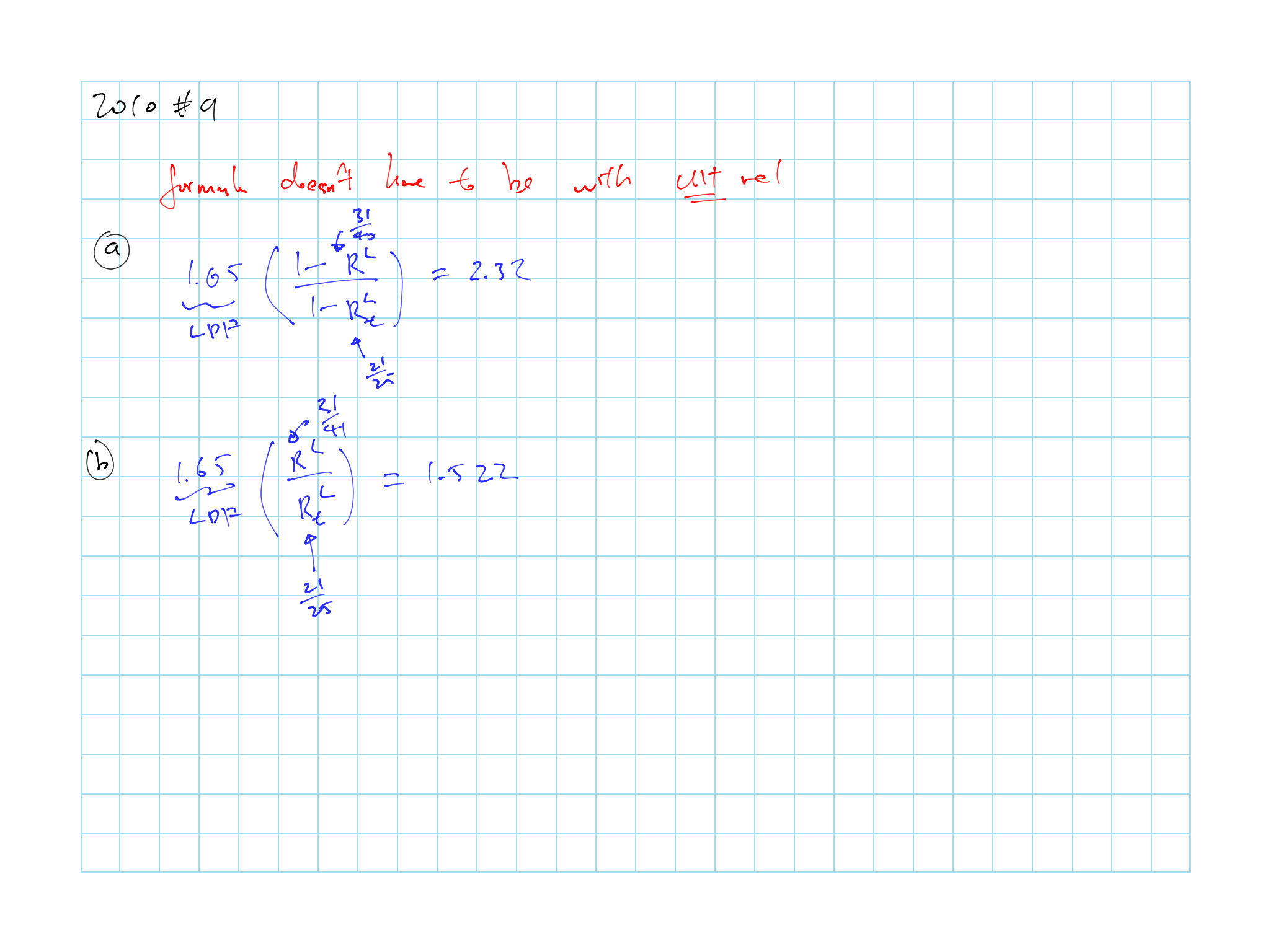

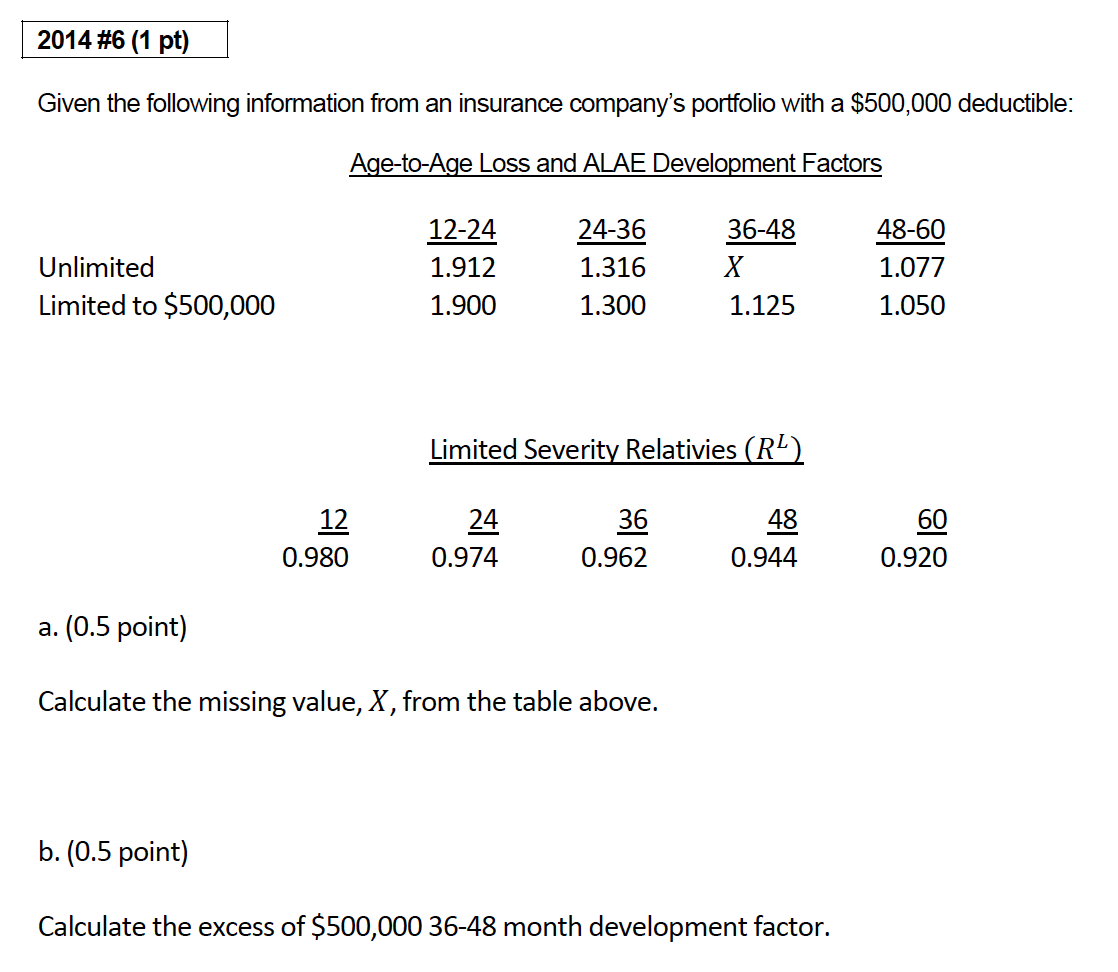

\(\star\) 2014 - #6 (7.4): Use incremental formula and also the combined formula

2015 - #6 a b: LR and implied dev method

TIA 1 & 2: Plug and play with relativities

TIA 3: plug and play with incremental rel

Full Calcualation

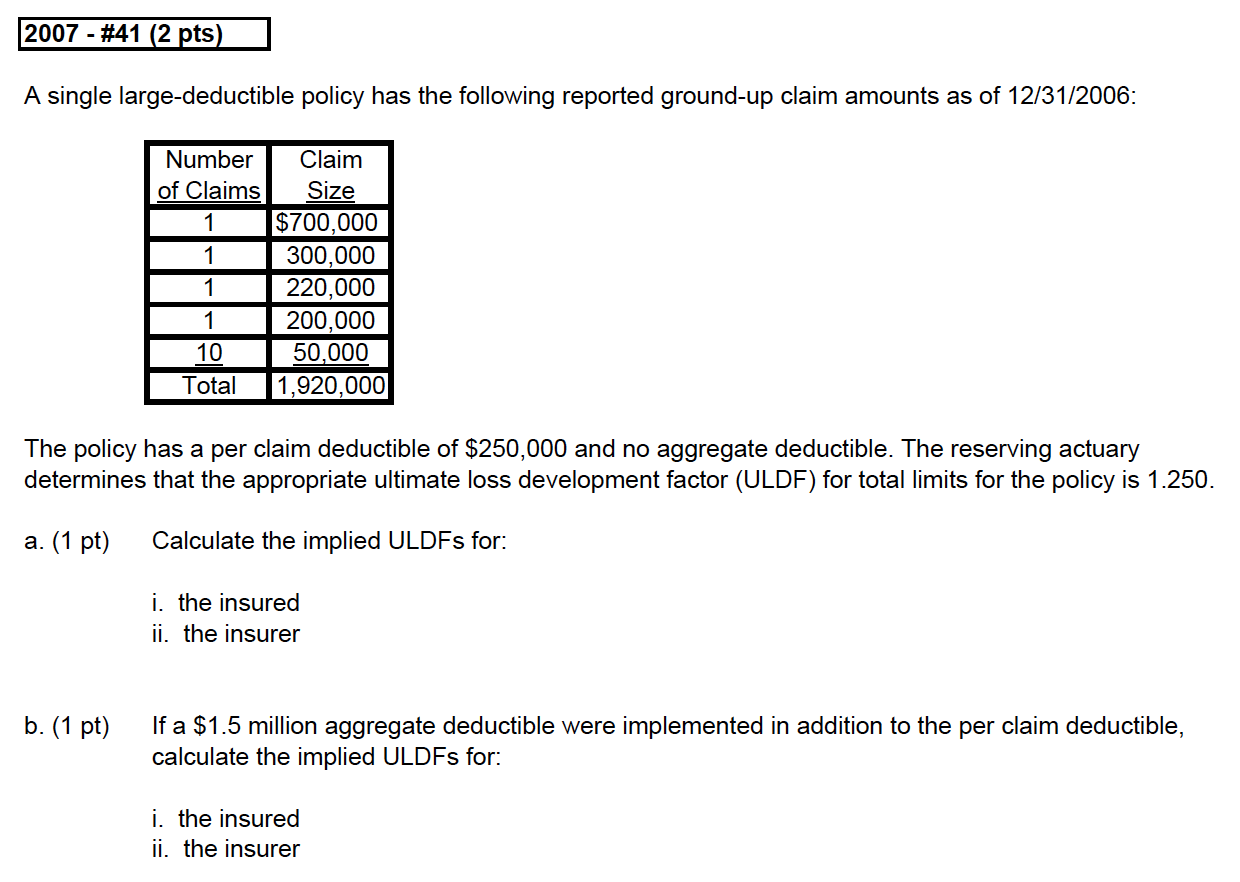

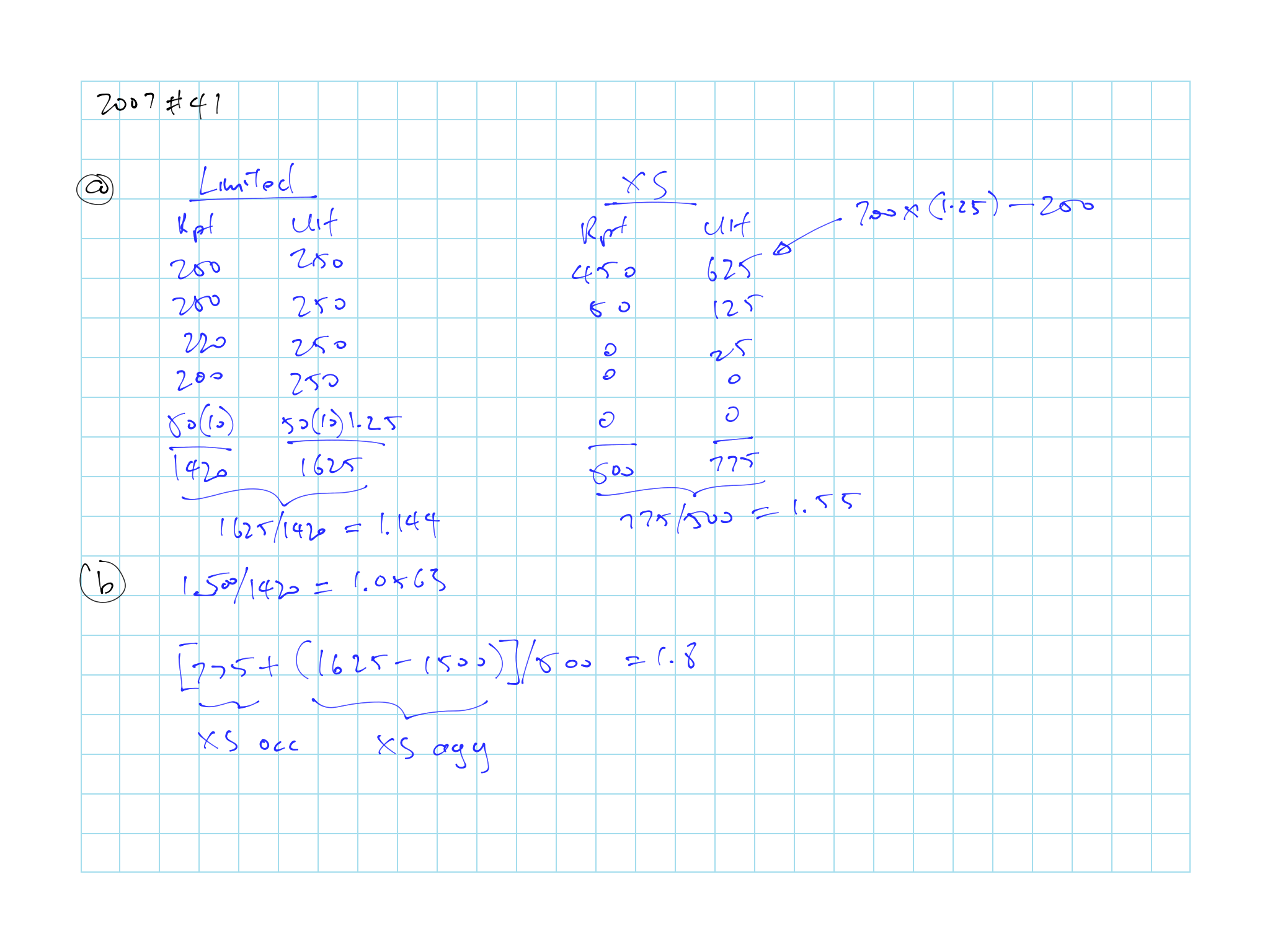

\(\star\) 2007 - #41 (7.2): XS and limited implied LDF calc from ground up with aggregate limit

2009 - #7: implied and direct development from triangle of unlimited and XS

2011 - #6 a b: Direct development and BF (slightly erroneous question)

\(\star \star\) 2015 - #6 c (7.5): Calculate layer between

\(\star\) 2016 - #9: Use industry and company XS development then the pros and cons of the 2 methods

\(\star\) TIA 4: reserve for policy with deductible and agg limit

- Lots of arithemtics

\(\star\) TIA 5: XS dev and Table M

7.9.1 Question Highlights

Figure 7.1: 2004 Question 21

Figure 7.1: 2004 Question 21

Figure 7.2: 2007 Question 41

Figure 7.2: 2007 Question 41

Figure 7.3: 2010 Question 9

Figure 7.3: 2010 Question 9

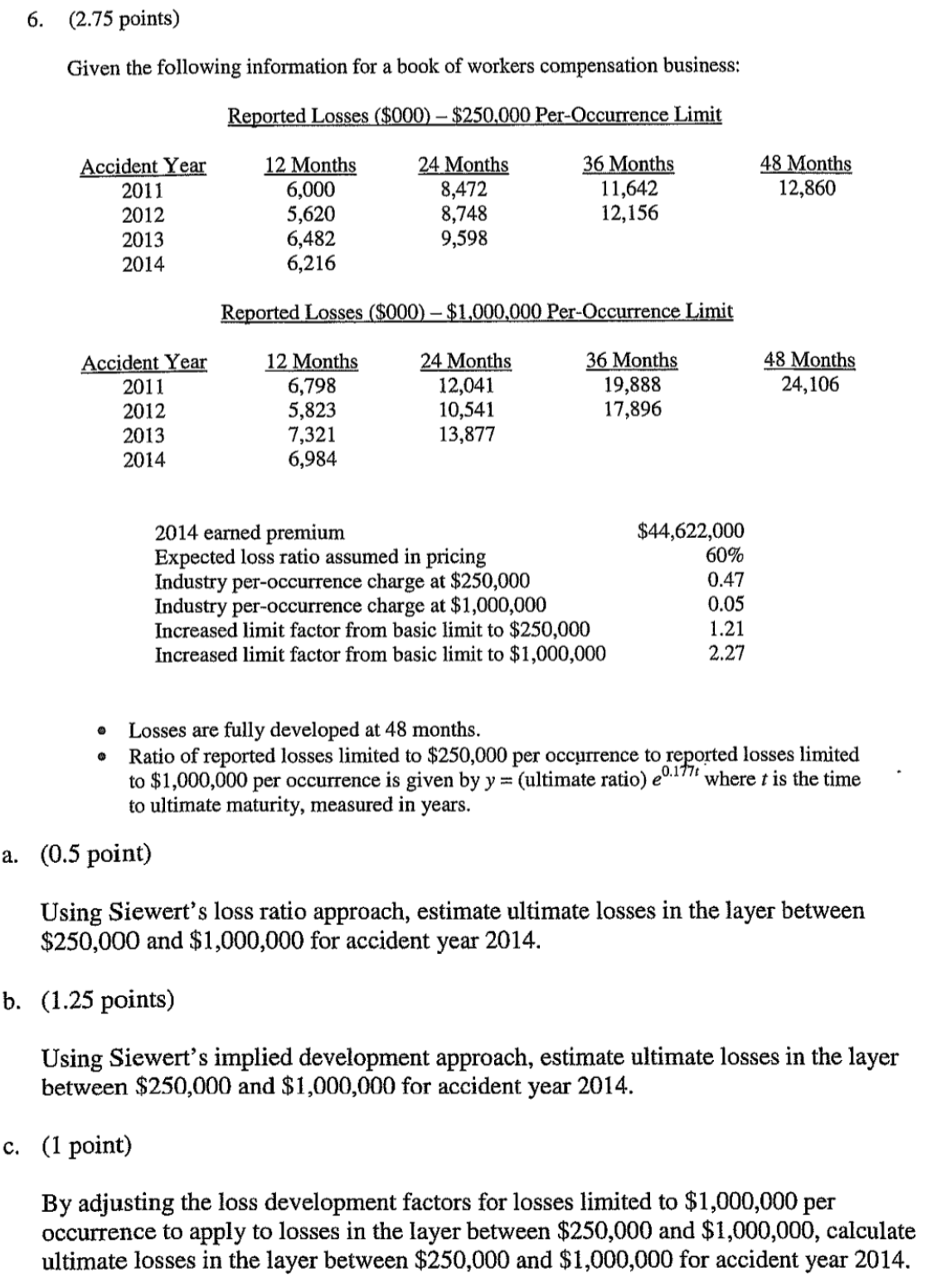

Figure 7.4: 2014 Question 6

Figure 7.4: 2014 Question 6

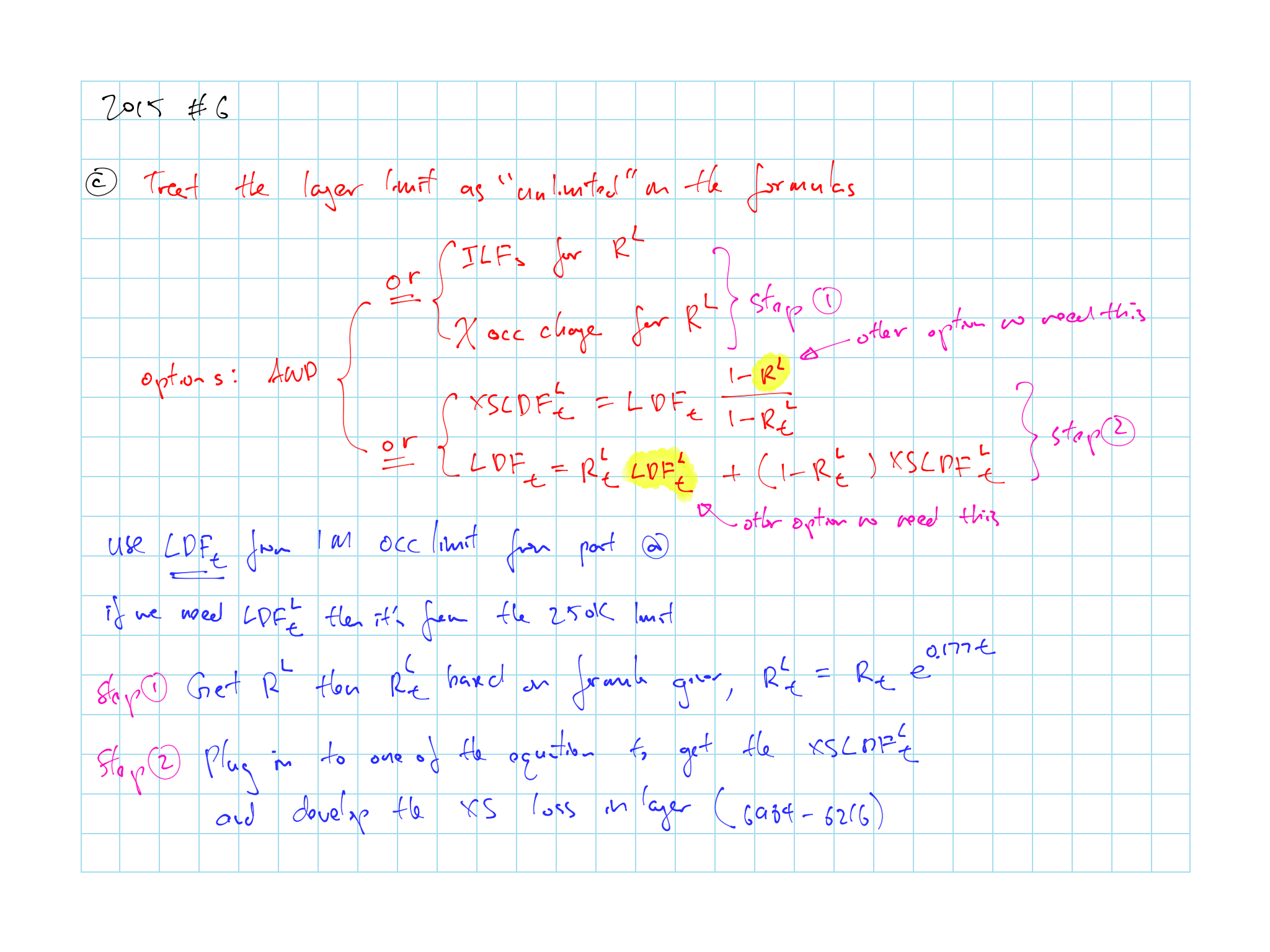

Figure 7.5: 2015 Question 6

Figure 7.5: 2015 Question 6