10.7 Past Exam Questions

Concepts

2012 #8b: Explain model as trade off between standard CL and BF

\(\star\) 2013 #9: Model specification stuff on variance of the prior, BF Bayesian

Bayesian vs Bootstrap: Provide expert opinion while maintaining the integrity of the variance estimates

Bayesian vs Mack: Provides full distribution of unpaid losses and not just the first 2 moments

\(\star\) 2014 #10: Expert opinions in LDFs or row parameters; \(\beta\) impact on the Bayesian model

\(\star \star\) 2016 #11 10.4: Various distribution assumptions

TIA 1: Chainladder intervention setup (LDF change)

TIA 4: Chainladder intervention setup (LDF based on industry)

\(\star\) TIA 5: Model setup change in exposure (bayesian with stochastic row parameter)

Full Calculation

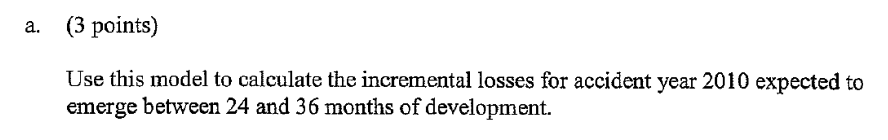

\(\star \star\) 2012 #8a 10.3: Bayesian model for BF method

TIA 2: Using \(\gamma\) for unpaid

\(\star\) TIA 3: BF unpaid estimate

\(\star\) TIA 6: Calculate \(\gamma\) and forecast with both the row and column parameters

\(\star\) TIA 7: Calculate \(\gamma\)

10.7.1 Question Highlights

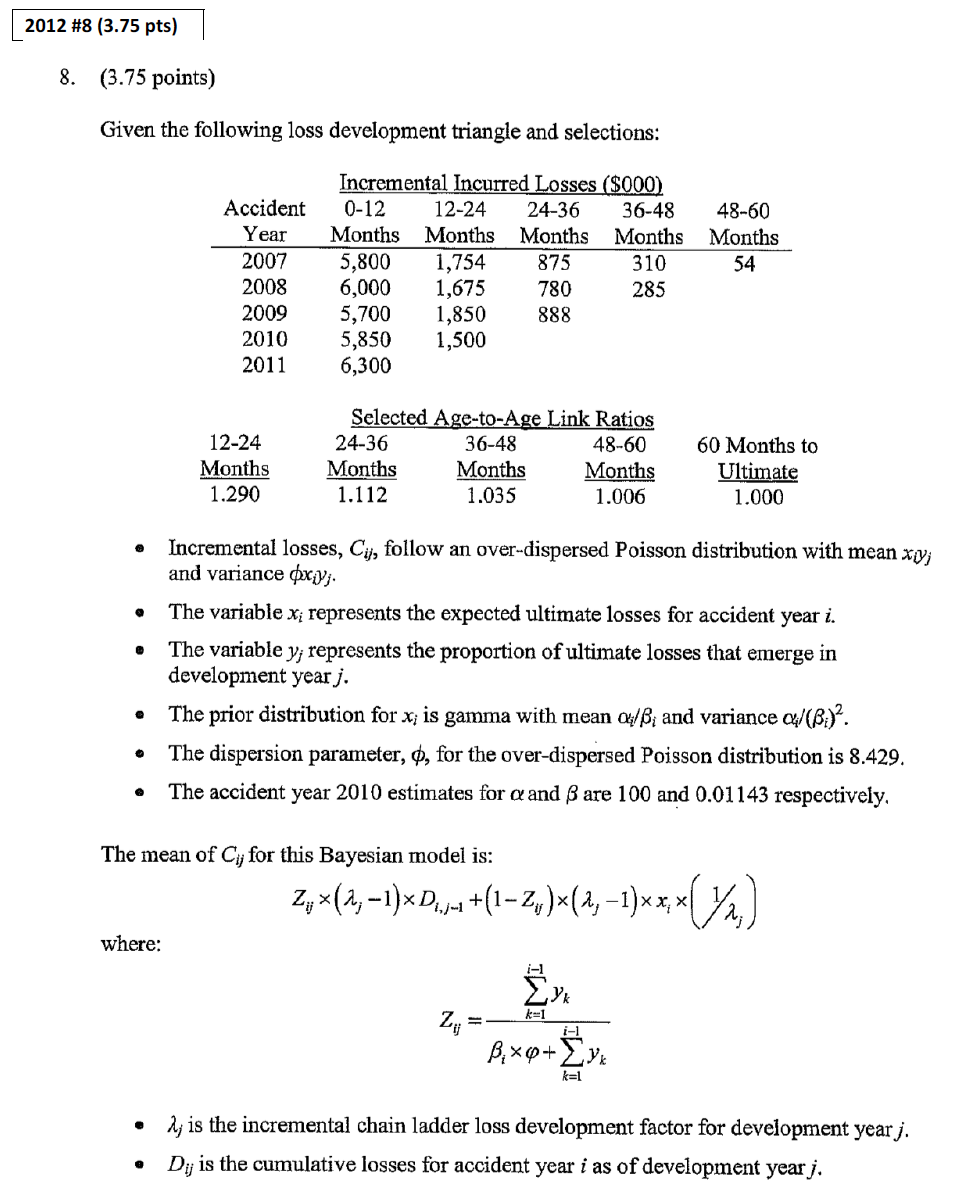

Figure 10.3: 2012 Question 8

Figure 10.3: 2012 Question 8

Figure 10.3: 2012 Question 8

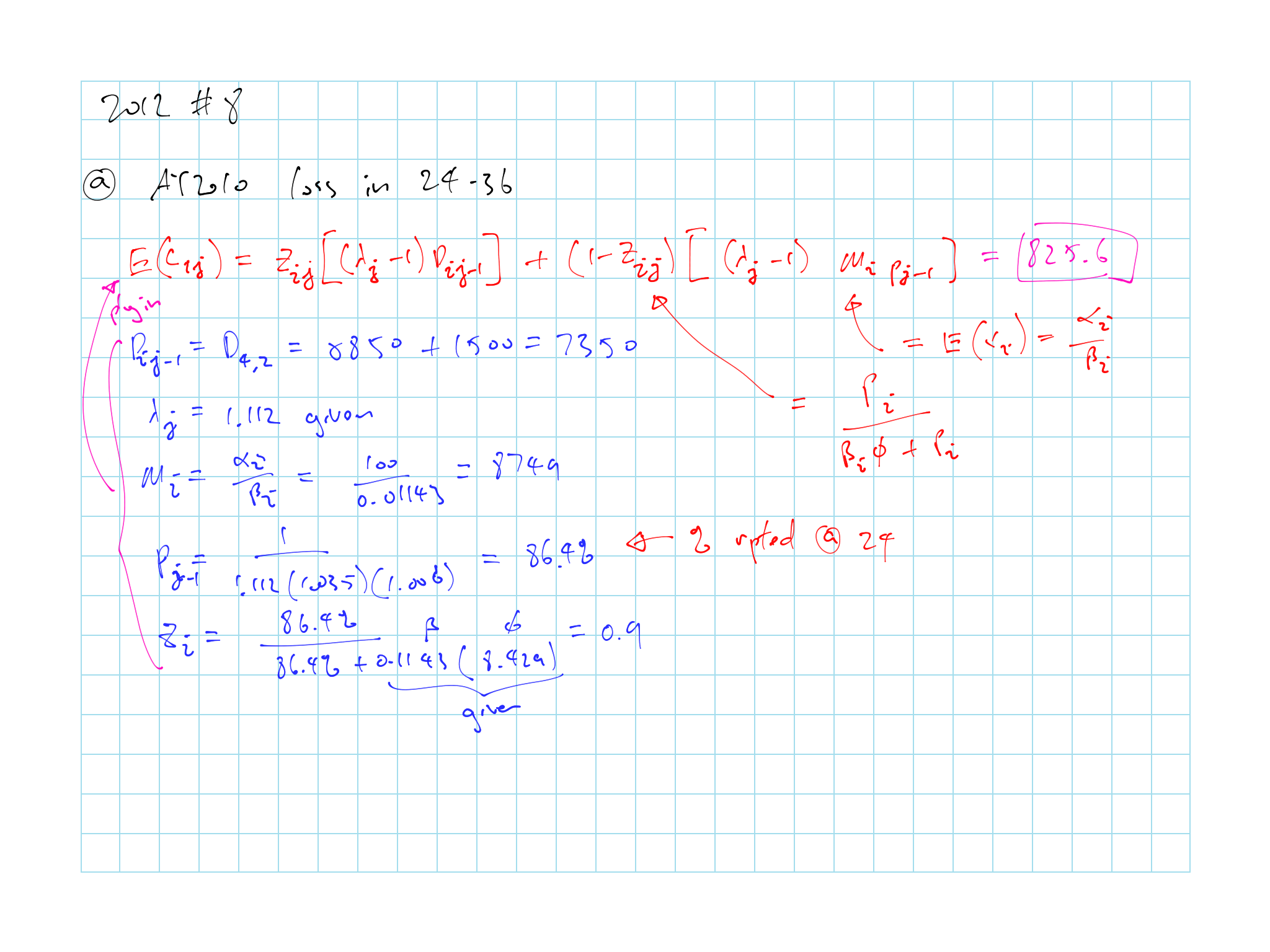

Figure 10.4: 2016 Question 11

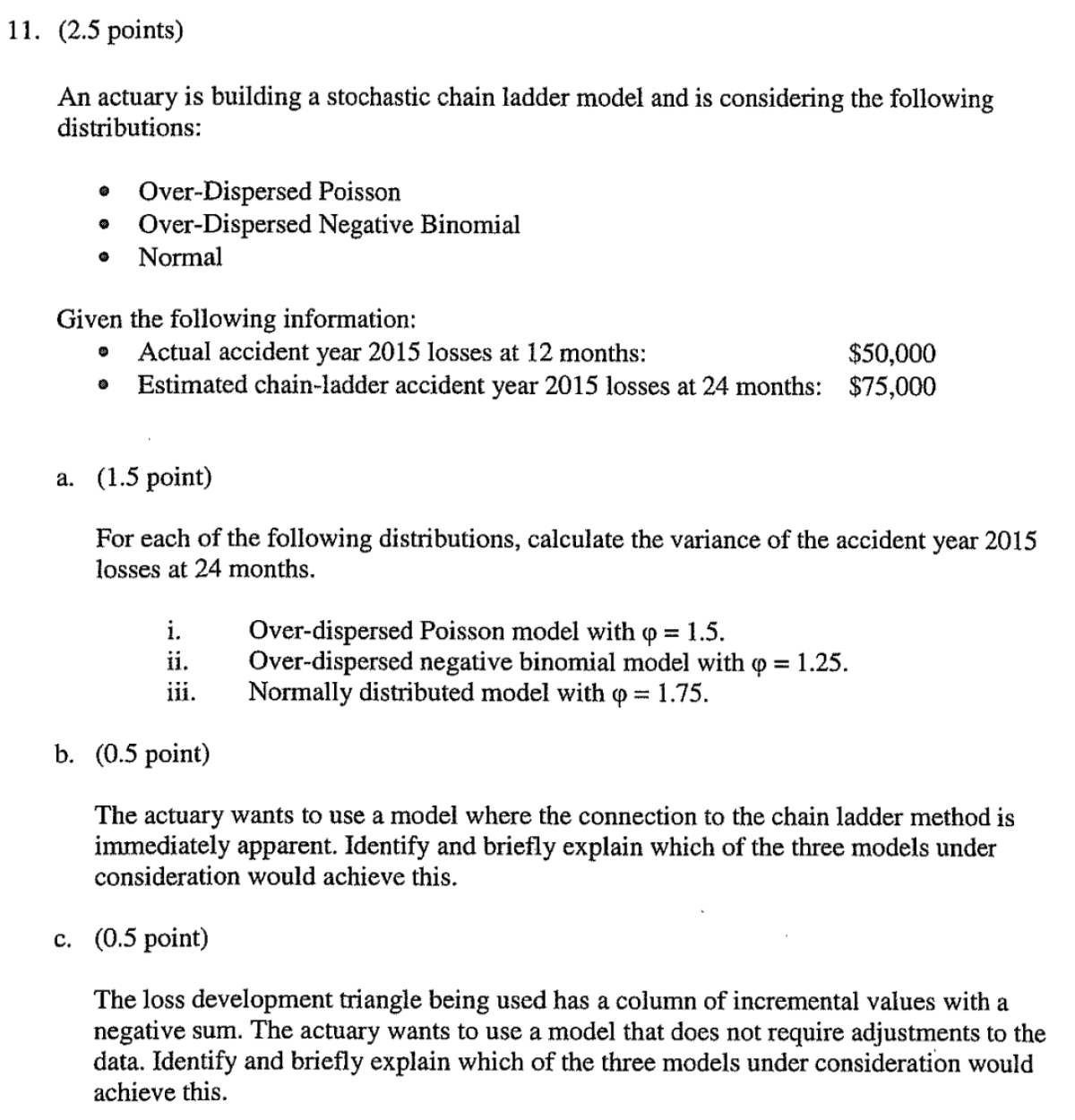

2016 Q11 Solution

Part a

Need the variance for the 3 distribution:

- ODP: \(\mathrm{Var}(c_{ij}) = \varphi m_{ij}\) (10.3)

\[m_{ij} = 75,000 - 50,000 = 25,000\]

\[\mathrm{Var}(c_{ij}) = 1.5 \times 25,000 = 37,500\]

- OD NB: \(\mathrm{Var}(c_{ij}) = \varphi \lambda_j \mathrm{E}[c_{ij}]\) (10.6)

\[m_{ij} = 75,000 - 50,000 = 25,000\]

\[\lambda_j = \dfrac{75,000}{50,000} = 1.5\]

\[\mathrm{Var}(c_{ij}) = 1.25 \times 1.5 \times 25,000 = 46,875\]

- Normal: \(\mathrm{Var}(D_{ij}) = \sigma^2_j D_{ij-1}\) (10.2)

\[\mathrm{Var}(c_{ij}) = 1.75 \times 50,000 = 87,500\]

Part b

Negative binomial beause \(\lambda_j\) is effectively a loss development factor similar to the chainladder

Part c

Normal because it’s the only one that can have negative output